UAE or India: Where Should NRIs Invest in Property in 2025?

August 5, 2025 Dubai

NRIs’ Property Choices: UAE vs India

In 2025, UAE offers NRIs higher rental yields and tax benefits, while India promises long-term growth and cultural ties.

UAE vs India: Where NRIs Should Invest in Real Estate in 2025

For Non-Resident Indians (NRIs) living in the UAE, choosing between investing in the UAE’s booming property market or buying real estate in India has become increasingly complex. While emotional connections often pull buyers toward Indian cities, financial considerations—rental yields, taxation, and loan costs—are increasingly favoring the UAE.

Why UAE Real Estate Appeals to NRIs

The UAE offers more than luxury developments. Its financial transparency, tax benefits, and strong rental returns make it highly attractive. Rental yields in Dubai range from 5% to 11%, with tax-free income and a globally appealing market.

Example: A Dubai property valued at Dh2.15 million (≈₹5 crore) can generate annual rent between Dh170,000 and Dh200,000 (₹40–50 lakh), translating to 6–7% yields.

Loan interest rates in the UAE hover around 5%, often resulting in cash-positive investments.

In contrast, similarly priced properties in India typically yield 2–4%, with loan rates of 9–10%, leading to negative monthly cash flows. The UAE also imposes no property tax, capital gains tax, or wealth/inheritance tax, boosting long-term wealth growth.

India’s Real Estate Market: Slowing but Steady

Cities like Mumbai and Delhi recorded up to 30% price growth in 2024, yet domestic demand is slowing, creating opportunities for NRIs. Challenges in India include:

Higher EMIs and lower rental yields

Property taxes and maintenance costs

Delays in construction and unclear land titles

Slower legal and transaction processes

A financial auditor notes that high EMIs can turn dream homes into financial burdens, highlighting the efficiency gap compared to UAE investments.

Who Should Invest Where?

UAE: Ideal for steady rental income, positive cash flow, low taxes, and near-term gains. The market is also more liquid, enabling faster sales.

India: Better for long-term appreciation, personal use, cultural ties, or retirement plans. Emerging Tier-2 cities may offer growth potential, albeit with regulatory hurdles.

Costs & Returns Comparison:

| Factor | UAE | India |

|---|---|---|

| Rental Yield | 5–11% | 2–4% |

| Loan Interest | ~5% | 9–11% |

| Taxes | None (4% one-time registration) | Property tax, rental income tax, capital gains |

| Liquidity | High | Moderate |

Final Thoughts

For pure investment returns in 2025, the UAE stands out for transparency, liquidity, and positive cash flow, especially for NRIs earning in dirhams. However, Indian real estate remains relevant for those prioritizing family use, retirement, or long-term cultural ties.

With the rise of remote work and digital property management, investing in UAE real estate is increasingly accessible and appealing to the Indian middle class in the Gulf.

Venezuela: Rodríguez Holds First Cabinet Meeting, Forms Commission for Maduro’s Release

Venezuela’s Vice President Delcy Rodríguez chaired her first cabinet meeting and announced a new commission focused on President Nicolás Maduro’s political and legal challenges.

5.4-Magnitude Quake Hits India’s Assam Near Bhutan Border

A moderate 5.4-magnitude earthquake struck Assam’s Dhing region near the India-Bhutan border early Monday, shaking homes but causing no immediate reports of major damage.

Boxer Anthony Joshua Injured in Nigeria Highway Crash That Killed Two

British boxing star Anthony Joshua was injured in a severe car crash on the Lagos-Ibadan Expressway in Nigeria. Two of his close team members died in the collision, and the vehicle’s driver has been charged with dangerous driving.

Earthquake of Magnitude 6.3 Jolts Southern Mexico; No Serious Damage Reported

A magnitude 6.3 earthquake struck the southern Mexican state of Guerrero on Friday, shaking buildings and triggering alarms, but authorities say there are no immediate reports of serious damage or injuries.

Canada’s transport regulator has asked Air India to investigate an incident where a pilot reportedly showed up for duty under the influence of alcohol, failing two breathalyzer tests at Vancouver International Airport.

Canada’s transport regulator has formally requested that Air India investigate an incident involving one of its pilots who reportedly reported for duty under the influence of alcohol, raising serious safety concerns for international aviation.

The incident occurred on December 23, 2025, at Vancouver International Airport when a pilot scheduled to operate Flight AI186 from Vancouver to Delhi was flagged by local authorities. According to reports, two breathalyzer tests conducted by the Royal Canadian Mounted Police (RCMP) confirmed that the pilot was under the influence of alcohol and therefore unfit for duty.

Transport Canada characterized the matter as a “serious matter” in a letter to Air India, noting that the pilot’s conduct may have violated multiple provisions of the Canadian Aviation Regulations (CARs) as well as conditions in Air India’s Foreign Air Operator Certificate.

As a result, Canadian authorities have asked Air India to carry out a detailed probe into the circumstances of the incident and submit corrective steps taken to prevent similar events in the future. Air India has been given a deadline of January 26, 2026 to respond with its findings.

In response, Air India confirmed that the flight was delayed and that a replacement pilot operated the aircraft. The airline reiterated its zero-tolerance stance on violations of safety and operational rules, and said the pilot involved has been removed from flying duties pending inquiry.

The incident has drawn attention amidst broader scrutiny of aviation safety practices, with regulators emphasizing strict compliance with safety protocols to protect passenger lives.

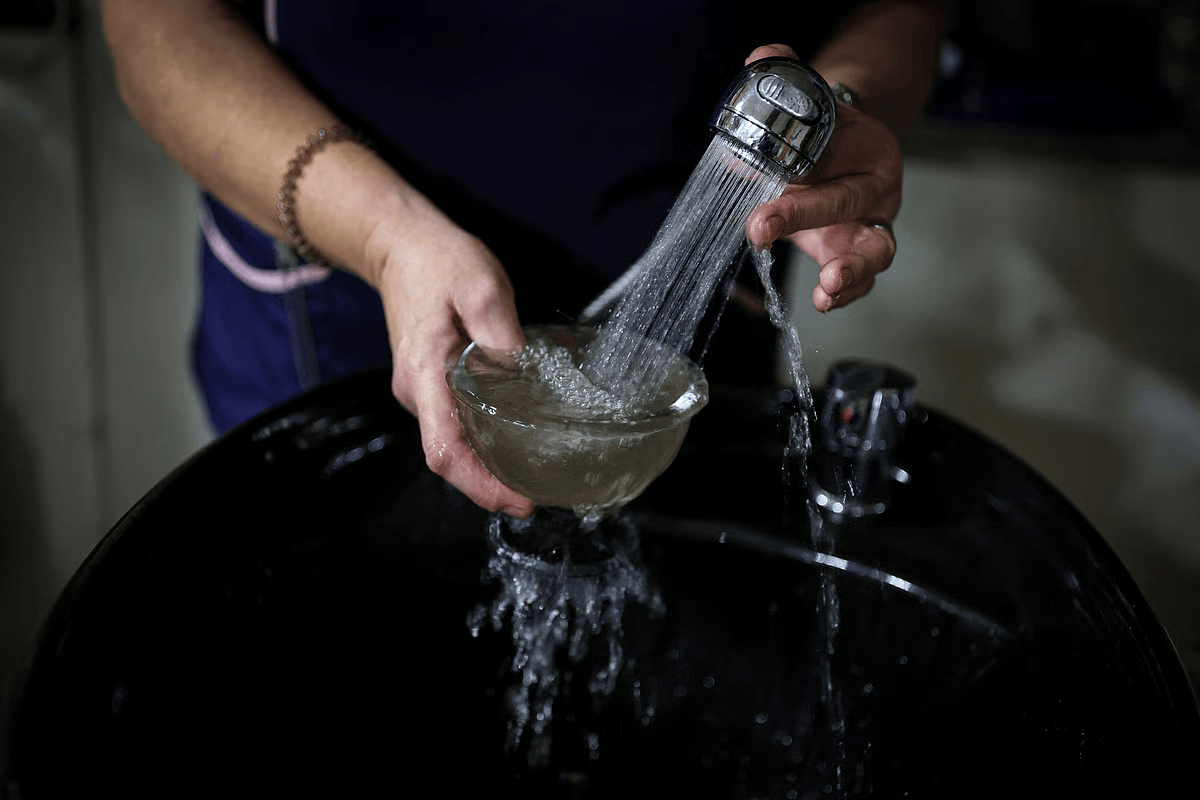

Contaminated Water Kills 9 and Hospitalises Over 200 People in Indore, India

At least nine people have died and more than 200 were hospitalised after consuming contaminated drinking water in Indore city, prompting an urgent investigation by local authorities.

Israel to Suspend Several Aid Groups Operating in Gaza Starting January 1

Israel has announced the suspension of multiple international aid groups operating in Gaza from January 1, citing security and regulatory concerns amid ongoing conflict.

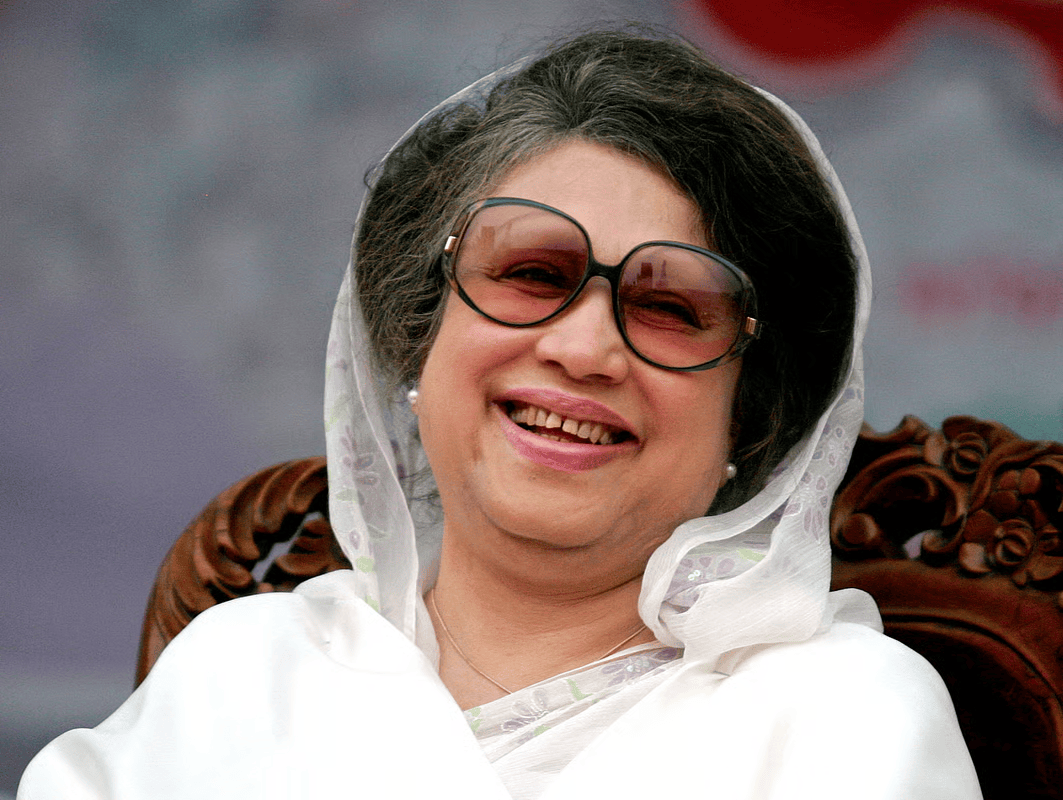

Bangladesh Announces State Funeral for Former PM Khaleda Zia; Three-Day National Mourning Declared

Bangladesh has declared a three-day state mourning following the death of former Prime Minister Begum Khaleda Zia. The government will accord her a state funeral with full honours, and flags will fly at half-mast across the country.

Over 3,600 Flights Cancelled and 30,000 Delayed as Powerful Bomb Cyclone Slams Parts of the US

A severe bomb cyclone has disrupted air travel across the United States, cancelling over 3,600 flights and delaying more than 30,000, causing widespread chaos for passengers and airlines.

Deeply saddened: India, Pakistan leaders condole death of Khaleda Zia

Leaders from India and Pakistan expressed deep sorrow and offered heartfelt condolences following the death of Bangladeshi political icon Khaleda Zia, acknowledging her legacy and contributions to South Asian politics.

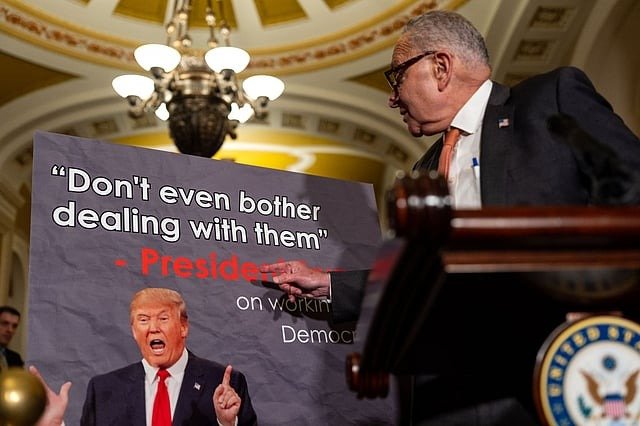

Trump tariffs risk losing India at pivotal moment, Democrats warn

Democrats caution that President Trump’s aggressive tariff policy toward India risks long-term harm to a critical strategic partnership at a time of rising global tensions.

12 killed in residential building fire in China's Guangdong

A late-night fire in a four-storey residential building in Shantou, Guangdong, killed 12 people. Authorities are investigating the cause as the region reels from recent deadly fires.

Magnitude 4.3 earthquake strikes Afghanistan

A magnitude 4.3 earthquake struck Afghanistan in the early hours of Wednesday, highlighting continued seismic activity in a country already vulnerable to recurring natural disasters.

A world on the brink: Why global hunger is rising despite abundant resources

Global hunger is worsening despite sufficient food resources, driven by conflict, climate shocks, economic fragility, and shrinking aid, pushing millions toward famine and instability.

Munir calls new CDF HQ ‘historic’, stresses tri-service integration in maiden address

In his first address as Chief of Defence Forces, Field Marshal Asim Munir described the new Defence Forces Headquarters as a landmark reform, stressing tri-service integration and the need to adapt to modern warfare domains such as cyberspace, AI, and information warfare.

IndiGo flight cancellations: Over 500 flights hit Friday, other airlines warn of delays

More than 500 IndiGo flights were delayed or cancelled on Friday, with Delhi and Chennai witnessing full shutdowns of departures. Passengers across India faced long waits, poor communication, and soaring alternative fares as IndiGo sought relief from new FDTL norms.

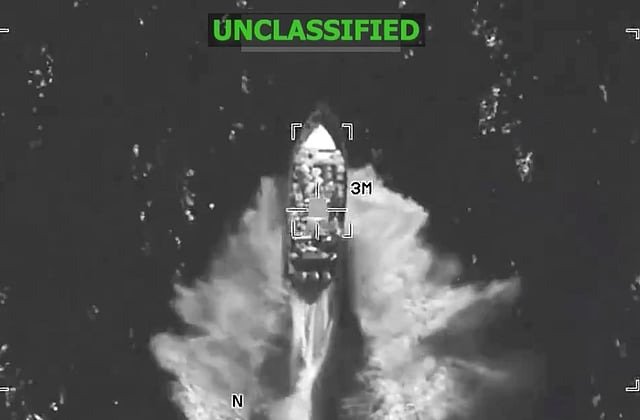

New US strike on alleged drug boat in Pacific kills four

A new US military strike on an alleged drug-trafficking vessel in the eastern Pacific has killed four people, intensifying scrutiny over Washington’s controversial anti-narcotics campaign, which has now resulted in 87 deaths.

Trump says he doesn't want Somalis in the US

President Donald Trump’s comments calling for Somali immigrants to leave the US have triggered sharp criticism from lawmakers, community leaders, and immigration experts.

How Australia plans to ban under-16s from social media

Australia is set to introduce a world-first ban preventing children under 16 from holding social media accounts, shifting responsibility onto platforms like Meta and TikTok to identify and remove underage users.

3.3 magnitude earthquake hits Bahrain, no impact in UAE

A mild 3.3-magnitude earthquake was recorded in Bahrain early Monday morning, with officials confirming no impact or tremors felt in the United Arab Emirates.

Chennai real estate firm Casagrand sends 1,000 employees on fully sponsored London trip

Chennai-based real estate developer Casagrand is sending 1,000 employees on a fully sponsored London trip as part of its unique employee reward and retention programme.

UAE offers condolences to China after deadly Hong Kong fire

The UAE has expressed deep condolences to China following a devastating apartment fire in Hong Kong’s Tai Po district that claimed many lives and left dozens injured.

US green cards under scrutiny: Why the Trump administration is re-examining 19 countries

The Trump administration has ordered a large-scale reassessment of green cards issued to immigrants from 19 countries, citing national security concerns after a deadly security incident in Washington, DC.

Saudi Arabia: Why deportations are on the rise

Saudi Arabia intensifies inspections and enforcement of residency, labour, and border rules, leading to a surge in deportations across the Kingdom.

Saudi influencer claims Georgina Rodriguez gave her the ‘evil eye’

A viral moment at a Riyadh fragrance launch sparks debate after Saudi influencer Al Anoud Al Yousef claims Georgina Rodriguez gave her the “evil eye” when a perfume demonstration went wrong.

Severe floods hit Thailand, authorities step in to help 1,000+ stranded tourists

Torrential rains triggered historic flooding across southern Thailand, forcing authorities to declare Hat Yai a disaster zone and mobilise emergency resources to rescue more than 1,000 stranded tourists.

Tejas plane crash in Dubai: IAF pilot Namansh Syal laid to rest in his native village with full military honours

Wing Commander Namansh Syal, who lost his life in the Tejas fighter jet crash at Dubai Airshow 2025, was cremated in his native village in Himachal Pradesh with full state and military honours amid emotional scenes.

Donald Trump’s son to visit Taj Mahal today along with 126 special guests from 40 countries

Donald Trump Jr. will visit the Taj Mahal today along with 126 international guests. Agra and Udaipur authorities have launched major clean-up and security preparations ahead of his India tour and high-profile wedding event in Rajasthan.

Rise of the robots: The promise of physical AI

Humanoid robots powered by physical AI are becoming more capable—from washing dishes to helping elderly people—yet challenges remain in cost, safety, and physical limitations.

Trump says designating Saudi Arabia major non-NATO ally

US President Donald Trump announced that Saudi Arabia will be designated as a major non-NATO ally during Crown Prince Mohammed bin Salman’s visit to the White House, strengthening defence, economic, and investment ties between the two nations.

Ukraine plans to buy up to 100 Rafale warplanes and air defence systems from France

Ukraine signs a 10-year plan to purchase up to 100 Rafale fighter jets, SAMP/T air defence systems, drones, and other military equipment from France to boost long-term security.

Iraq election ends without majority, PM's coalition leads

Iraq’s latest parliamentary election concluded without a majority winner, with Prime Minister Al-Sudani’s coalition securing the largest number of seats, triggering complex negotiations to form the next government.

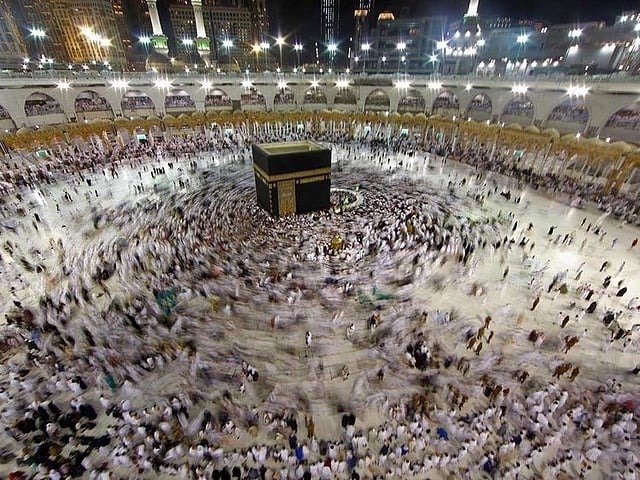

Saudi bus accident: 18 Indian Umrah pilgrims from one family killed, three generations lost

A horrific bus accident near Madinah killed 18 members of a single Hyderabad family, wiping out three generations of Umrah pilgrims.

Camel crashes through car roof in India head-on collision

A stray camel crashed through the roof of a car in Rajasthan after a head-on collision, injuring the driver and trapping the animal inside the vehicle for nearly two hours.

India: Class 6 student dies after being forced to do 100 sit-ups for arriving late

A 12-year-old student from Vasai, Maharashtra, died after allegedly being forced to do 100 sit-ups for arriving late to school, sparking protests and an official inquiry.

Pakistan’s top court judges resign after move to cut its power

Two senior judges resigned hours after Pakistan’s parliament passed sweeping constitutional amendments that reduce judicial authority and boost the military chief’s powers.

Srinagar blast: 9 killed as Faridabad explosives go off at Jammu and Kashmir police station

Nine people, mostly police and forensic staff, died after confiscated explosives accidentally detonated at Srinagar’s Nowgam Police Station; investigators are probing both accidental and terror-related angles.

Donald Trump to visit India, sends positive signals on US-India relations

US President Donald Trump says talks with PM Modi are “going great,” hinting at reduced tariffs and a potential visit to India in 2026 as hopes rise for a long-awaited bilateral trade deal.

Breaking barriers: Pakistani women firefighters transform emergency services

A growing number of young women in Pakistan are joining firefighting and rescue services, breaking gender stereotypes and transforming the country’s emergency response landscape.

Truck hits pedestrians in South Korea market, killing 2 people and injuring 18

A truck crashed into a crowded market in Bucheon, South Korea, killing two people and injuring eighteen others. Authorities are investigating the driver's claim of vehicle malfunction.

Trump defends H-1B visas, says 'you do need to bring in talent'

President Donald Trump has defended the need for skilled foreign workers, saying the US “must bring in talent,” even as his administration enforces tougher visa rules and a $100,000 H-1B application fee.

Delhi Red Fort car blast: Police invoke terror law as Modi cites 'conspiracy'

A deadly car explosion near Delhi’s Red Fort Metro Station killed 13 and injured several others. Police have invoked anti-terror laws, while Prime Minister Modi has termed the incident a “conspiracy.”

Donald Trump booed as the 1st sitting US president at a regular-season NFL game since Carter in 1978

President Donald Trump was met with boos from spectators while attending the Washington Commanders vs. Detroit Lions NFL game, becoming the first sitting US president at a regular-season match since Jimmy Carter in 1978.

National Day holidays announced in Oman for public, private sectors

Oman has declared November 26 and 27, 2025, as official National Day holidays for both public and private sector employees, marking the country’s first-ever two-day National Day celebration under a new royal decree.

Dubai Metro Unifies Operations To Cut Service Recovery Time By 80%

Dubai Metro has merged its Operations Control Centre and Engineering Control Centre, reducing service-recovery time by 80% as part of its smart mobility upgrade.

Uae dubai to build 60 affordable schools by 2033 creating 120000 newstudentseats

The emirate has announced a major education drive to construct 60 affordable private schools by 2033, adding 120,000 seats and improving access for middle- and low-income families.

Afghanistan, Pakistan to resume truce talks in Istanbul

Afghan and Pakistani negotiators will meet in Istanbul on Thursday to revive ceasefire discussions, seeking to prevent renewed fighting after last month’s deadly border clashes that left over 70 dead and hundreds injured.

Inside the Grand Egyptian Museum: Where ancient treasures meet modern marvels

Egypt unveils the Grand Egyptian Museum in Giza — a $1 billion cultural masterpiece showcasing Tutankhamun’s full treasure collection, ancient artefacts, and modern design that celebrates the nation’s timeless heritage.

OpenAI and Amazon sign $38 billion deal for AI computing power

OpenAI has partnered with Amazon in a $38 billion deal to power ChatGPT and other AI systems using Amazon Web Services and Nvidia chips, marking a major shift from its long-time dependence on Microsoft’s cloud infrastructure.

Explosion reported at Supreme Court building in Islamabad

A powerful gas explosion in the basement cafeteria of Pakistan’s Supreme Court building in Islamabad injured twelve people and caused significant damage, prompting an immediate security lockdown and investigation.

Coimbatore college student abducted, raped near airport; boyfriend brutally assaulted

A 20-year-old Coimbatore college student was abducted and assaulted near the airport after her boyfriend was brutally attacked. Police have launched special teams to trace the suspects.

Google and Jio launch free 18-month AI Pro access for millions in India

Google and Reliance Jio have partnered to provide millions of Jio users in India with 18 months of free access to Google’s Gemini AI Pro plan — a deal worth ₹35,100 per user.

Indian expats in UAE: Major Aadhaar update takes effect November 1

From November 1, 2025, Aadhaar holders — including UAE-based NRIs — can update key details like name, address, birth date, and mobile number completely online, eliminating the need for in-person visits.

Ready for iOS 26.1? Apple preps major fixes and feature enhancements for iPhone

Apple is gearing up to release iOS 26.1 — bringing major fixes, smoother music controls, Liquid Glass customization, and automatic security updates to iPhones worldwide.

Saudi Arabia announces new amendments to Umrah visa rules

Saudi Arabia has reduced Umrah visa validity from three months to one month from issuance. The visa will now be cancelled if unused after 30 days, as part of efforts to manage the growing number of pilgrims and improve travel efficiency.

Saudi Arabia to host world at Expo 2030 Riyadh,197 nations invited

Saudi Arabia is preparing to welcome 197 nations and 42 million visitors for Expo 2030 Riyadh, a landmark global event focusing on innovation, sustainability, and education, with major infrastructure projects nearing completion.

Trump heads to Asia and high-stakes meeting with Xi

US President Donald Trump embarks on a major Asia tour covering Malaysia, Japan, and South Korea, culminating in a crucial meeting with Chinese leader Xi Jinping amid renewed trade tensions and global security concerns.

Trump heads to Asia and high-stakes meeting with Xi, North Korea on the agenda

President Donald Trump embarks on a major Asia tour with a high-stakes meeting set with China’s Xi Jinping in South Korea on October 30, as trade tensions, North Korea’s missile tests, and regional diplomacy dominate the agenda.

Trump warns Israel would lose ‘all US support’ if it annexes West Bank

US President Donald Trump warned Israel that it would lose all American support if it annexes the West Bank, stressing his commitment to Arab nations and ongoing peace efforts.

‘We sleep in the street’: Gaza families return to ruins after ceasefire

As a fragile ceasefire takes hold, thousands of Palestinians return to Gaza City to find their homes destroyed and lives in ruins, clinging to hope amid devastation.

Syrian leader seeks reset in Russia relations in Putin meeting

Syrian interim President Ahmad Al Sharaa met Vladimir Putin in Moscow to reset relations and discuss Russia’s military bases, while urging the extradition of former leader Bashar Al Assad.

US Defence Secretary Pete Hegseth's plane forced to land after reporting cracked windshield

Pete Hegseth’s aircraft was forced to land in the UK after its windshield cracked mid-flight while returning from a NATO meeting in Brussels.

Tribal leader in Iraq tries to cut off his fingers in bizarre display of political loyalty

An Iraqi tribal leader attempted to cut off his fingers during a campaign rally to prove loyalty to Prime Minister Mohammed Shia’ Al Sudani, sparking outrage and debate over extreme political allegiance.

UAE Golden Visa Benefits: 8 perks you get with the 10-year residency

UAE Golden Visa Benefits: 8 Exclusive Perks of the 10-Year Residency

Diwali trip to Dubai? New UAE visa updates and travel tips for Indian tourists

Planning a Diwali getaway to Dubai? Here’s everything Indian travellers need to know about UAE’s latest visa updates, costs, eligibility, and travel tips for a smooth, festive trip this 2025.

Trump urges Israel to seize chance for peace

US President Donald Trump urges Israel to turn battlefield victories into a lasting peace, pledging American support for Gaza’s reconstruction and calling on Palestinians to reject violence as he visits Jerusalem amid a fragile ceasefire.

Dubai court orders insurer to pay Dh1.26 million after luxury car crash

A Dubai court has ordered an insurance company to pay Dh1.26 million to another insurer after rejecting claims that a collision between a Bentley and a Mercedes was staged. The court ruled the crash was genuine and upheld the compensation claim.

First 7 Israeli hostages held in Gaza released, Trump en route to Israel

The Red Cross begins overseeing the release of Israeli hostages and Palestinian prisoners as part of a US-brokered ceasefire between Israel and Hamas. Around 48 hostages and nearly 2,000 detainees are expected to be freed in the first phase, signaling cautious hope for lasting peace.

UN chief calls for Israel, Hamas to ‘abide fully’ by terms of US peace plan

UN Secretary-General António Guterres has called on Israel and Hamas to fully comply with the newly announced US-brokered peace deal, emphasizing the need for a permanent ceasefire, humanitarian access, and a lasting two-state solution to end the long-standing conflict in Gaza.

20 living hostages for 2,000 Palestinian prisoners: Israel, Hamas agree on ‘first phase’ of Gaza peace deal, says Trump

Under a landmark agreement brokered by U.S. President Donald Trump, Israel and Hamas have approved the first phase of a Gaza peace framework that includes the release of 20 hostages in exchange for 2,000 Palestinian prisoners.

China bolsters export controls on rare-earth industry

Beijing expands export restrictions on rare-earth materials and technologies, escalating global concerns over supply chains crucial to electronics, defence, and clean energy industries.

US flight delays: Staffing shortages reported as shutdown reaches 7th day

Air-traffic controllers and TSA officers warn of growing risks, unpaid workers reach breaking point

UK: What Starmer said about relaxing visa rules for India

UK Prime Minister focuses on business and investment, not immigration, before key India visit

Trump 'happy' to work with Democrats on health care, if shutdown ends

As the U.S. government shutdown enters its second week, President Donald Trump says he is open to negotiating with Democrats on health care reforms, but only after federal operations are restored.

Egypt’s Khaled El Anany elected Director-General of UNESCO, becoming first Arab to lead the organisation

Egypt’s former Minister of Tourism and Antiquities, Dr. Khaled El Anany, becomes the first Arab Director-General of UNESCO, marking a historic milestone in global cultural diplomacy.

All visa types now eligible for Umrah, says Saudi Hajj ministry

In a landmark move, Saudi Arabia has announced that holders of all visa types — including tourist, work, family, and transit visas — can now perform Umrah, reflecting the Kingdom’s ongoing efforts to make pilgrimage more accessible and seamless for Muslims worldwide.

Riyadh Season 2025 to open on Friday with mega parade, global stars, record-breaking attractions

Riyadh Season 2025 kicks off on October 10 with a massive parade, record-breaking attractions, and global celebrities, marking a new era in Saudi Arabia’s cultural and entertainment transformation.

Qatar launches world’s largest 3D-printed building project with two futuristic schools

Doha begins printing phase of two massive 3D-printed schools covering 40,000 sqm, setting a new global benchmark in digital construction.

Oman to build Sultanate's first 3D printed mosque

Dhofar Governorate signs landmark agreement to construct a sustainable mosque inspired by Omani heritage, blending tradition with cutting-edge 3D printing technology.

Alaskan climbing star Balin Miller dies in fall from Yosemite's El Capitan

Balin Miller, celebrated for his daring ascents and boundless passion for climbing, tragically fell to his death while rope-soloing Yosemite’s iconic El Capitan.

Trump urges Israel to halt Gaza bombings as Hamas agrees to release hostages

Hamas shows willingness to release hostages under Trump’s peace proposal, while Israel signals cautious support. Civilian suffering continues as war nears two years.

US government enters shutdown as Congress fails to reach funding deal

The US government entered a shutdown after lawmakers failed to reach a funding deal. President Trump blamed Democrats as key services halt and hundreds of thousands of workers face furloughs.

Philippines earthquake: Cebu province declares state of calamity

A powerful 6.9 magnitude earthquake struck Cebu, Philippines, leaving widespread damage, casualties, and thousands in urgent need of aid. Authorities have declared a state of calamity as rescue efforts intensify.

Donald Trump says Israel backs Gaza peace plan

US President Donald Trump says Israel has agreed to his Gaza peace plan, which calls for a ceasefire, hostage releases, and Hamas disarmament. Hamas approval is still pending.

Israeli PM Netanyahu faces empty hall as delegates exit UN session, delivers Gaza speech

Israeli PM Benjamin Netanyahu’s UN address on Gaza was marked by a dramatic walkout, as he defended Israel’s war strategy, rejected Palestinian statehood, and vowed to continue the fight against Hamas.

Trump announces 100% tariff on drugs, 50% on kitchen cabinets: Major blow for global importers

US President Donald Trump announces sweeping tariffs — including 100% on pharmaceuticals and 50% on kitchen cabinets — raising inflation concerns and rattling global markets.

5 dead as storm Opong slams eastern Philippines: Dawn videos reveal devastation

Severe tropical storm Opong (Bualoi) slams Samar and Masbate, toppling power lines, flooding towns, and displacing thousands across the eastern Philippines.

World’s only floating post office on Kashmir’s Dal Lake attracts tourists

The world’s only floating post office, anchored on Srinagar’s Dal Lake, combines heritage and utility, offering both postal services and a unique cultural experience to visitors.

Asia Cup Super Four: Talat, Nawaz guide Pakistan to a hard-fought win

Hussain Talat and Mohammad Nawaz shared a crucial 58-run partnership as Pakistan overcame early wickets to beat Sri Lanka by five wickets in a thrilling Asia Cup Super Four clash at Abu Dhabi’s Zayed Cricket Stadium.

14 killed, 124 missing in Taiwan after barrier lake burst

At least 14 people were killed and 124 remain missing in Taiwan’s Hualien County after a decades-old barrier lake burst during Super Typhoon Ragasa, triggering flash floods and mudslides.

Remit now? New money exchange rates for India rupee, Pakistan rupee, Philippine peso

Asian currencies remain weak against the UAE dirham, giving Indian, Pakistani, and Filipino expatriates better value when sending remittances home. Here’s a closer look at today’s exchange rates and what they mean for families.

France formally recognises Palestinian state at UN summit

France, joined by the UK, Canada, Australia, and Portugal, formally recognised Palestine at a UN summit, intensifying global calls for an end to the Gaza war.

India beat Pakistan by six wickets in Asia Cup Super Four: Match highlights, key moments and more

Abhishek Sharma’s explosive 74 and a solid team effort powered India to a six-wicket win over Pakistan in the Asia Cup Super Four clash in Dubai.

Trump praises conservative 'giant' Kirk at mega memorial event

At a massive memorial in Arizona, President Trump praised slain activist Charlie Kirk as a “giant of his generation.” The event drew thousands, with Elon Musk and top Trump officials in attendance.

Oman arrests six expats in social media blackmail scam

Six Arab nationals were arrested in Oman for running a social media romance scam, blackmailing a victim, and defrauding him of over OMR 200,000. Police urge residents to remain vigilant against online fraud.

Asia Cup 2025: Axar Patel doubtful for India’s Super Four clash against Pakistan after head injury

Axar Patel’s head injury against Oman has cast doubt on his availability for India’s Asia Cup Super Four match versus Pakistan, with Washington Sundar and Riyan Parag on standby.

Trump hits H-1B visas with $100k fee, rolls out $1 million 'gold card' residency

US President Donald Trump has signed executive orders introducing a $100,000 annual fee on H-1B visas and unveiling a $1 million “Trump Gold Card” residency scheme, shaking up the tech industry and immigration landscape.

6.1-magnitude earthquake hits Indonesia's Central Papua: USGS

A powerful 6.1-magnitude earthquake shook Indonesia’s Central Papua province near Nabire, according to USGS. Local authorities reported aftershocks but no immediate major damage or casualties.

Qatar takes legal steps at ICC over Israeli strike on Doha

Qatar has launched legal proceedings at the International Criminal Court (ICC) against Israel after a deadly airstrike on Doha killed six people. Doha says it will pursue accountability for war crimes and acts of aggression, marking a historic escalation in the Gulf state’s international legal strategy.

Explained: Pakistan and Saudi Arabia’s watershed defence pact

A landmark agreement between Pakistan and Saudi Arabia pledges joint defence against aggression, marking a new era of strategic cooperation with wide regional implications.

UAE Central Bank cuts key interest rate for first time in 2025, mirroring US Fed move

The Central Bank of the UAE lowered its base rate on the Overnight Deposit Facility from 4.40% to 4.15%, following the US Federal Reserve’s 25-basis-point rate cut.

DCT Abu Dhabi and Amazon join forces to launch world's largest digital Arabic library

The Department of Culture and Tourism – Abu Dhabi and Amazon have partnered to create the world’s largest Arabic digital library, making thousands of books and audiobooks accessible globally.

iPhone 17 launch: All you need to know about the ultra-thin iPhone Air, AirPods Pro 3, Apple Watch Ultra 3

Apple’s September 2025 event introduced the ultra-thin iPhone Air, upgraded AirPods Pro 3, and Apple Watch Ultra 3 with advanced features, pricing, and UAE release dates.

India-Pakistan Asia Cup: Cheapest ticket options revealed

Asia Cup 2025 tickets are now on sale, with India–Pakistan clash seats starting at Dh350. Affordable options across UAE stadiums ensure fans don’t miss the cricket festival.

Dh200,000 fine for hospital staff in Dubai over death of foetus: Al Khaleej

Two doctors and two nursers at a private hospital in Dubai were ordered by the Dubai Civil Court to pay Dh200,000 in compensation to the parents of a fetus who died in the mother’s womb during delivery.

At Least 8 Dead in 'Terrorist' Attack on Judiciary Building in Southeast Iran

Eight people, including civilians and attackers, were killed during a terrorist attack on a judiciary building in Zahedan, southeastern Iran.

Kuwait: Pilot and Doctor Arrested for Unlicensed Ammunition and Illegal Alcohol Possession

Kuwaiti officials have arrested a doctor and pilot for possessing unlicensed ammunition and alcohol, uncovering 500 bullets and illegal liquor supplies. Let me know if you want an SEO-optimized blog post format too.

Lebanese Music Icon Ziad Rahbani, Son of Fairuz, Dies at 69

Legendary Lebanese composer and playwright Ziad Rahbani, son of Fairuz, has died at 69. Renowned for his powerful music and satirical theatre, Rahbani leaves behind a lasting cultural legacy.