Dubai Holding and Palantir create Aither to scale AI across the UAE economy

November 4, 2025 Dubai

Dubai Holding and Palantir Launch Aither to Drive AI Growth in UAE

Dubai Holding and Palantir Technologies have launched Aither, a joint venture designed to accelerate applied AI adoption across UAE industries and support the nation’s digital economy goals.

Dubai Holding and Palantir Join Forces to Launch Aither, UAE’s New AI Powerhouse

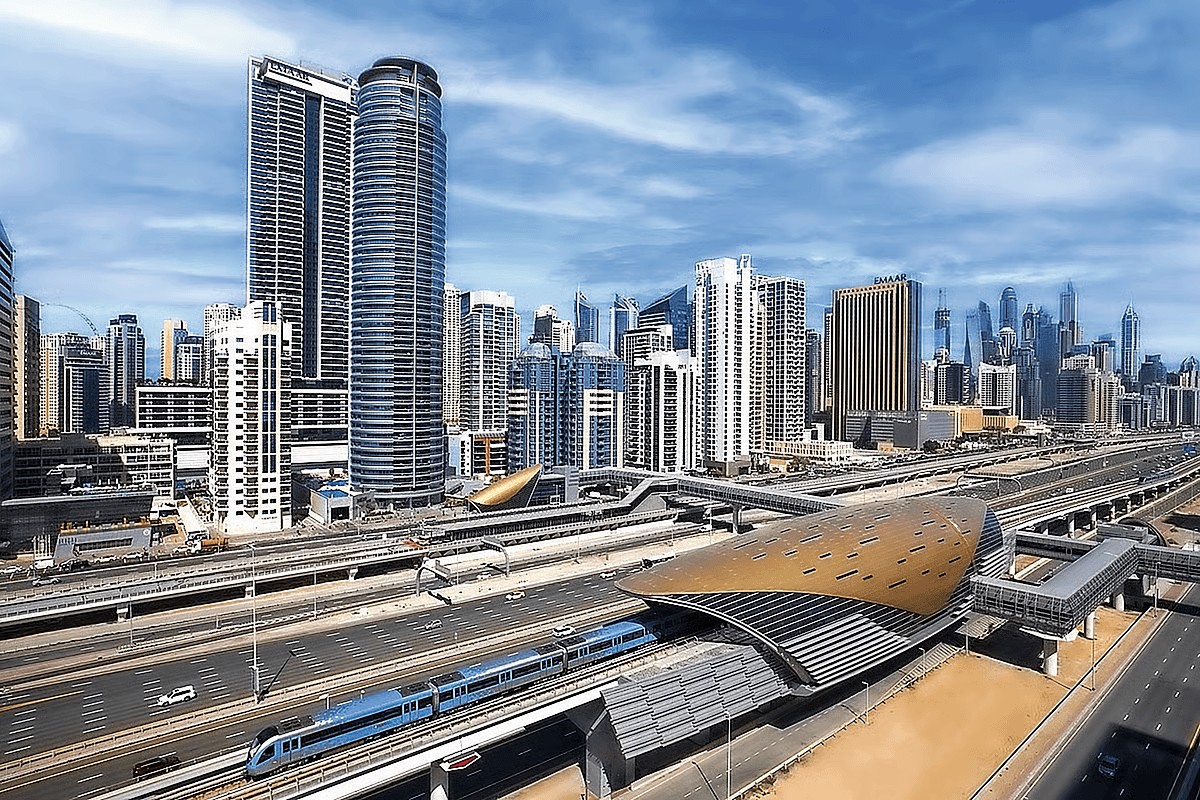

Dubai has officially launched Aither, a new artificial intelligence (AI) company created through a joint venture between Dubai Holding and Palantir Technologies. The move aims to scale AI deployment across the UAE’s public and private sectors, reinforcing the nation’s position as a global leader in digital transformation.

The agreement was signed in Dubai in the presence of Sheikh Ahmed bin Saeed Al Maktoum, Chairman of Dubai Holding, and Mohamed bin Hadi Al Hussaini, UAE Minister of State for Financial Affairs. The signing ceremony featured Amit Kaushal, Group CEO of Dubai Holding, and Noam Perski, Executive Vice President at Palantir.

Aither represents the culmination of 18 months of successful collaboration between the two organizations. During that time, Dubai Holding and Palantir developed and implemented advanced AI systems across sectors including real estate, hospitality, finance, and infrastructure, delivering tangible benefits to major brands such as Nakheel, Meraas, and Jumeirah.

Accelerating Applied AI Across UAE Industries

Aither’s mission is clear — to industrialize artificial intelligence across key UAE industries and unlock measurable value in both public and private enterprises. The platform will focus on applying AI to real-world operations, driving efficiency, innovation, and data-driven decision-making.

Early use cases have already demonstrated significant results:

Improved operational efficiency across Dubai Holding’s subsidiaries.

Faster decision-making through real-time data visibility.

Enhanced productivity in core business areas such as logistics, finance, and customer engagement.

Building on these successes, Aither will now extend these capabilities to a wider ecosystem of organizations across the UAE.

Supporting Dubai’s Digital Economy Vision

The creation of Aither directly supports the Dubai Economic Agenda D33, which aims to generate Dh100 billion annually through digital transformation initiatives. The D33 vision seeks to position Dubai among the top three global cities for business, technology, and innovation.

By localizing AI expertise and promoting responsible adoption, Aither will contribute to the UAE’s national goals — including economic diversification, digital leadership, and the creation of future-ready talent.

Amit Kaushal, Group CEO of Dubai Holding, emphasized:

“Through Aither, we are extending proven AI capabilities to the wider market, supporting Dubai’s digital ambitions and the UAE’s goal to accelerate economic diversification and strengthen its global leadership in the digital economy.”

Palantir’s First UAE Joint Venture

For Palantir Technologies, the launch of Aither marks its first joint venture in the UAE — and a major milestone in its strategy to localize AI infrastructure for national economies.

Aither will leverage Palantir’s powerful AI platforms — such as Foundry and Artificial Intelligence Platform (AIP) — to build secure, sovereign, and high-impact applications tailored for UAE institutions.

Palantir’s expertise in data integration and AI-powered analytics, combined with Dubai Holding’s market experience and sector reach, positions Aither as a key enabler of digital innovation in the UAE and across the wider MENA region.

Building Local AI Talent and Governance Frameworks

Beyond technology, Aither’s mandate also includes knowledge transfer and skills development to nurture a domestic AI talent pipeline. The initiative will work closely with government entities, corporations, and academic institutions to train UAE nationals in AI-driven decision-making, data engineering, and ethical AI governance.

Aither will also play a role in helping UAE organizations implement responsible AI frameworks, ensuring that automation and data technologies are deployed ethically, securely, and in line with national policies.

A Step Toward the UAE’s AI-Driven Future

The launch of Aither represents a strategic leap in the UAE’s journey to become a global hub for artificial intelligence. By combining Palantir’s advanced technology with Dubai Holding’s diverse portfolio and strategic influence, Aither is poised to accelerate AI adoption at scale — transforming industries, boosting productivity, and driving sustainable growth across the UAE economy.

As the UAE continues to place AI at the heart of its future economy — targeting up to 20% GDP contribution from AI by 2031 — Aither will serve as a cornerstone of this vision, shaping a smarter, more connected, and innovation-driven nation.

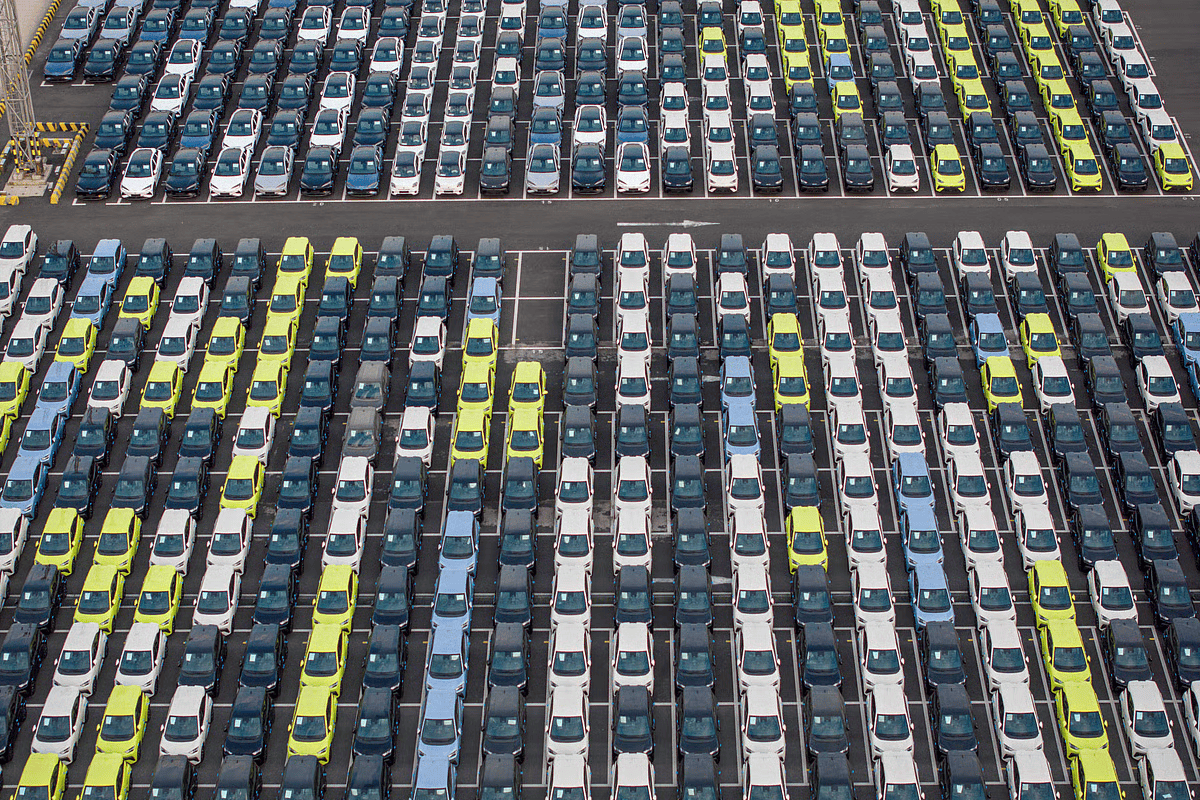

Europe’s Auto Industry Future May Be Electric Even After EU Climbdown

Despite easing regulations on combustion engines, Europe’s auto industry continues moving strongly toward an electric future.

No Major Rent Increases at Renewal as Dubai’s Smart Rental Index Guides Hikes

Dubai tenants receive relief as the Smart Rental Index ensures fair, data-driven rent increases during renewal periods.

Bulgaria Adopts the Euro, Nearly 20 Years After Joining the EU

Bulgaria officially adopted the euro on January 1, 2026, becoming the 21st member of the eurozone and marking a historic milestone nearly two decades after joining the European Union.

UAE–India Flights: Airline Introduces Dh2 Discounted Price for Excess Baggage

Travelers flying between the UAE and India can now enjoy a special Dh2 discounted rate on excess baggage, making international travel more affordable and convenient.

Global Islamic Finance Set to Reach $6 Trillion by 2026 Amid Strong Double-Digit Growth

Global Islamic finance is rapidly expanding, driven by rising demand for Shariah-compliant banking, investments, and ethical financial solutions worldwide.

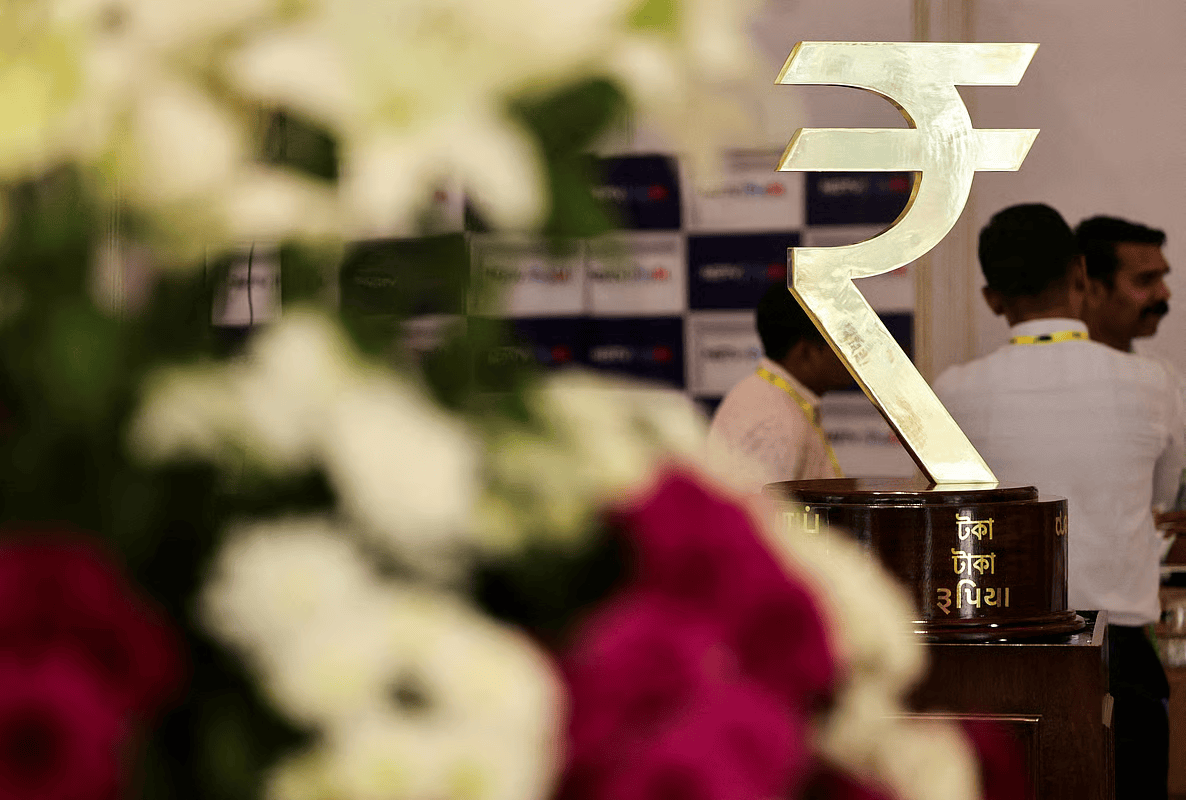

Indian Rupee Slips to Record Low Against UAE Dirham, RBI Likely to Curb Further Losses

The Indian rupee has weakened to a record low against the UAE dirham, raising concerns over imports, inflation, and foreign trade. However, the Reserve Bank of India (RBI) is expected to step in to limit excessive volatility and stabilize the currency market.

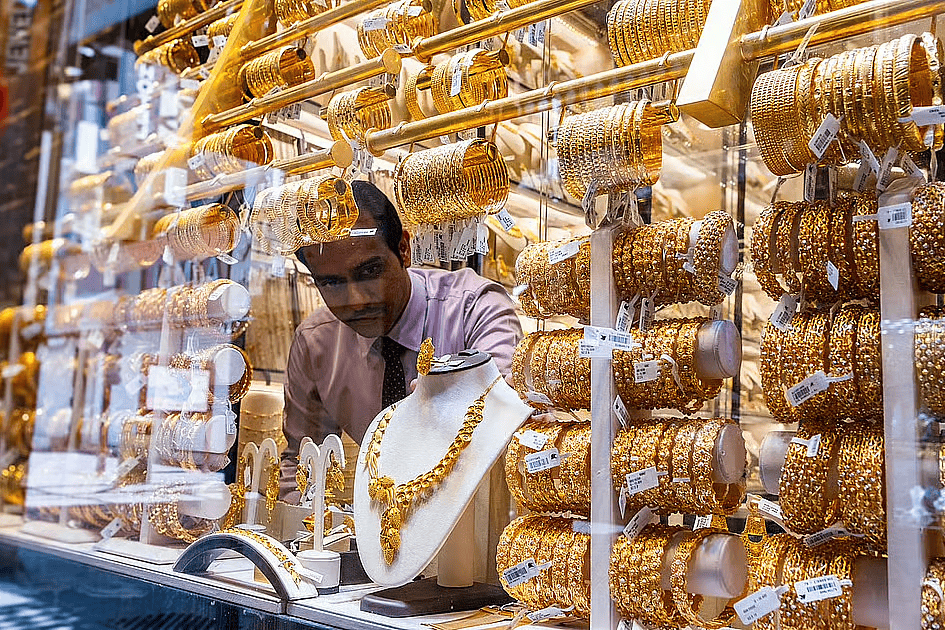

Dubai Gold Prices Drop Further on Last Day of 2025 After Record-Breaking Year

Dubai gold prices fell further on the final day of 2025, closing a year marked by historic highs, strong investor demand, and global economic uncertainty.

Cricket Heats Up as DP World ILT20 Season 4 Enters the High-Voltage Playoffs

The DP World ILT20 Season 4 playoffs promise thrilling cricket action as top teams battle for championship glory.

China’s BYD Poised to Overtake Tesla in Global EV Sales by 2025

China’s electric vehicle giant BYD is rapidly closing the gap with Tesla and is expected to lead global EV sales in 2025, driven by affordability, innovation, and strong domestic demand.

Time to Buy? Dubai Gold Prices Plunge Nearly Dh18 Per Gram in 24 Hours

Dubai gold prices witnessed a sharp fall of nearly Dh18 per gram within 24 hours, attracting buyers and investors looking for the right opportunity to purchase gold at lower rates.

Building a Future Through Talent and Leadership Across Every Sector

Empowering businesses and communities by fostering talent, cultivating leadership, and driving innovation across all industries.

Riviera Residences by MERED – Luxury Waterfront Living on Al Reem Island

Experience unparalleled luxury and serenity at Riviera Residences by MERED, offering stunning waterfront views and modern lifestyle amenities on Al Reem Island.

How Oman’s Partial Cheque Payment System Works

Oman’s partial cheque payment system allows banks to process available funds even when the full cheque amount is not covered. This system protects beneficiaries, reduces cheque bounce cases, and promotes fair financial practices under Omani banking regulations.

Use a strong passcode, enable biometric lock, shorten auto-lock time, and restrict lock-screen previews for messages; use cellular data or own hotspot for banking and email'

For many travellers, connecting to a free wifi network at an airport or charging a phone at a public port is almost second nature. However, for cybercriminals, it is the perfect moment to strike.

Dubai’s Trusted Social Media Manager for Business Growth

Professional social media management services in Dubai to grow your brand on Instagram, Facebook, LinkedIn, and Google with real engagement and leads.

Middle East gas sector eyes $200 billion investment to meet surging power demand

Energy leaders say the Middle East must invest $200 billion by 2030 to boost natural gas output by 30% as the region faces soaring electricity demand driven by population growth, desalination, and AI infrastructure.

Dubai shoppers wake up to higher gold prices after a quiet week

Gold rates in Dubai climbed on Thursday following a quiet week, reflecting global market gains after the US Federal Reserve’s latest interest rate cut.

Abu Dhabi launches new finance cluster set to create 8,000 jobs by 2045

Abu Dhabi has launched the FIDA finance cluster, aiming to create 8,000 skilled jobs, attract over $4.6 billion in investment, and add $15.2 billion to GDP by 2045.

Dubai's most expensive table? Spend Dh200,000 to welcome New Year 2026

Dubai’s hospitality scene is preparing for New Year’s Eve 2026 with extravagant dining and entertainment packages, including a Dh200,000 VIP table, as premium venues see early sell-outs.

Govt orders IndiGo to cut flights by 10% — over 200 daily services hit

India’s Civil Aviation Ministry has directed IndiGo to reduce its daily operations by 10% after mass flight cancellations, affecting over 200 services each day as authorities step in to stabilise operations.

UAE NRIs may soon find it easier to carry gold home as India plans customs overhaul

India is planning a major revamp of its customs system, raising hopes among UAE-based NRIs for clearer, less stressful rules when carrying gold home, especially during the wedding and festive travel season.

New UAE tax rules from 2026: What the changes really mean, who they benefit

From January 1, 2026, updated UAE tax rules will clarify refund timelines, expand audit powers, and introduce binding directions by the Federal Tax Authority, reshaping how businesses and taxpayers interact with the tax system.

Remit or hold? Indian rupee, Pakistani rupee, Philippine peso stay weak in UAE

The Indian rupee, Pakistani rupee, and Philippine peso continue to trade near multi-year lows against the UAE dirham, offering favourable remittance opportunities for UAE expatriates. Here’s what current rates mean and how expats are planning transfers.

RBI slashes repo rate to 5.25% in unanimous vote, calls conditions 'goldilocks'

The RBI has reduced the repo rate by 25 bps to 5.25%, citing historically low inflation and strong GDP growth. Retail loan EMIs are expected to fall as liquidity measures support monetary transmission.

Mbank, 7X revolutionise UAE's logistics and e-commerce payments with AE Coin integration

Mbank and 7X have partnered to introduce AE Coin — the UAE’s first AED-pegged stablecoin — across logistics, e-commerce, and digital services, enabling faster, secure, and fully regulated blockchain payments nationwide.

Dubai gold recovers with 24k at Dh507.50 as US rate cut bets dominate December

Gold prices in Dubai recovered strongly, with 24k touching Dh507.50 a gram, driven by festive demand and growing expectations of a US interest rate cut in December.

Dubai 24k gold surges above Dh510 amid National Day break

Dubai’s gold market rallied sharply during the National Day break, with 24-carat gold crossing Dh511 per gram, driven by festive demand, global rate-cut expectations, and strong safe-haven buying.

This Dubai startup just raised $17 million to change how you buy phones, laptops

Dubai-based Revibe has secured $17 million in fresh funding to expand its refurbished electronics marketplace globally, aiming to make buying “as-good-as-new” devices affordable, trustworthy, and mainstream.

UAE tax rule changes from 2026: 5 major updates businesses need to know

Starting January 1, 2026, the UAE will introduce significant tax procedure reforms aimed at improving transparency, certainty, and efficiency, helping businesses manage refunds, audits, and compliance with greater clarity.

How architect-led property development is paving the way for better communities in the UAE

Across the United Arab Emirates, a growing shift toward architect-led property development is transforming how communities are planned, built, and experienced—placing people, sustainability, and long-term value at the heart of real estate growth.

Microsoft ramps up $15.2b UAE investment to supercharge AI growth

Microsoft has significantly expanded its long-term investment in the United Arab Emirates, committing $15.2 billion between 2023 and 2029 to strengthen artificial intelligence, cloud infrastructure, skilled talent development, and sovereign digital capabilities.

Dh2.5 billion housing package for UAE citizens in 2025

The UAE Cabinet has approved housing assistance worth Dh2.5 billion for Emirati citizens in 2025 through the Sheikh Zayed Housing Programme, reinforcing family stability and long-term urban development goals.

Airbus A320 recall: Global flight disruption warning as 6,000 jets grounded

An urgent Airbus directive affecting up to 6,000 A320-family aircraft worldwide is forcing airlines to ground jets for software and hardware fixes, raising the risk of delays and cancellations across global networks.

UAE coffee drinkers face inevitable price hikes as Arabica bean costs soar

Soaring Arabica coffee prices, climate disruptions, and global trade pressures are pushing UAE cafés and roasters toward unavoidable price hikes despite booming demand.

UK budget: What drives Britons to UAE apart from tax relief and sunshine

Rising taxes and failing public services are pushing British families toward the UAE, but access to fast, high-quality healthcare is now a major driver of the migration trend.

Why more UAE investors are trusting AI to manage their money

A new survey shows rising trust in AI among UAE investors, with over 70% willing to let artificial intelligence manage their portfolios amid market volatility.

UAE petrol, diesel prices for December: Will fuel rates be lower at the pump soon?

With global oil markets softening and November prices declining, UAE motorists may see another drop or stable fuel rates when December petrol and diesel prices are announced.

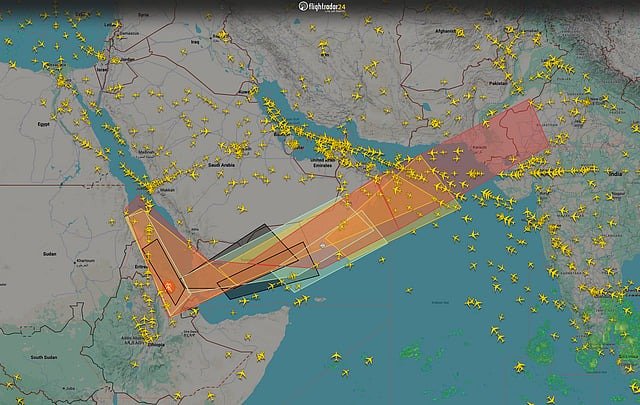

India-UAE travel disrupted: Several flights cancelled and rerouted due to Ethiopian volcano ash

Flights between India and the UAE face major disruption as the volcanic ash cloud from Ethiopia’s Hayli Gubbi eruption forces airlines to cancel and reroute services, with ash expected over northern India by Tuesday night.

Dubai gold price inches toward Dh500 after traders price in 80% Fed cut chance

Dubai gold prices rose toward the Dh500 level as global markets price in a strong chance of a December US Federal Reserve rate cut, driven by weak economic signals and delayed US data releases.

Dubai real estate demand climbs as global talent shifts from US to UAE

Demand for Dubai property is rising sharply as highly skilled professionals relocate from the US and other Western markets, driven by Golden Visas, tax advantages and policy shifts affecting global mobility.

Dubai gold price drops to Dh489.75 with markets pricing a 60% chance of Fed rate cut

Gold prices in Dubai slipped to Dh489.75 for 24K as traders price in a 60% probability of a US Federal Reserve rate cut, following recent global fluctuations and economic uncertainty.

ArcelorMittal billionaire Lakshmi Mittal leaves UK for Dubai amid tax reforms

Billionaire steel tycoon Lakshmi Mittal is relocating from the UK to Dubai as concerns rise over new tax rules targeting wealthy residents, including exit and mansion tax proposals.

Dubai gold price is cooling again after a wild start to November

Dubai’s gold market has settled into a tight price range after a volatile start to November, as traders watch global rate expectations and shifting bullion sentiment.

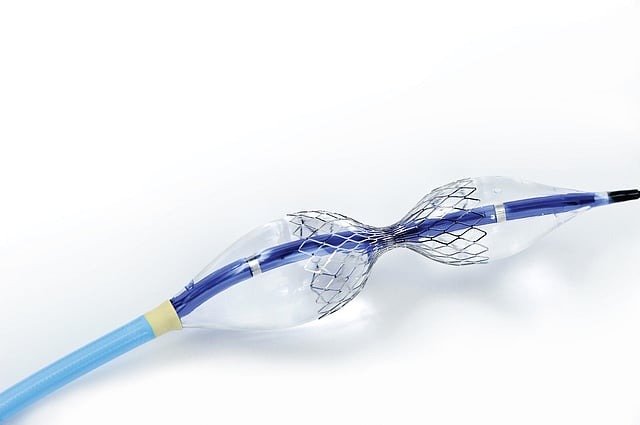

Cleveland Clinic Abu Dhabi performs UAE’s first Coronary Sinus Reducer procedure

Cleveland Clinic Abu Dhabi has successfully carried out the UAE’s first Coronary Sinus Reducer (CSR) procedure, offering new hope to patients with severe, treatment-resistant angina.

India seeks tankers for Mideast oil after Russia sanctions

With new sanctions on major Russian oil producers, India is rapidly booking tankers from the Middle East, pushing freight rates to near five-year highs.

CFI Group strengthens Board of Directors with appointment of global experts

CFI Group has added three internationally recognised leaders to its Board of Directors, reinforcing its commitment to governance, innovation, and sustainable global growth.

What first-time home buyers, Golden Visa investors pay—and gain—in Dubai

A detailed look at fees, requirements, and benefits for Dubai’s first-time home buyers compared to investors seeking a Golden Visa through property.

Dubai ranks first regionally, second globally among top destinations for winter tourism

Dubai has been ranked first in the region and second in the world for winter tourism, thanks to its perfect weather, vibrant attractions, and world-class experiences.

Dubai gold steadies near Dh492 while global traders rethink Fed outlook

Gold prices in Dubai remain stable around Dh492 for 24K as global traders scale back expectations of a December US Federal Reserve rate cut.

Dubai welcomed 1.04m British tourists in first nine months of 2025

Dubai saw a 13% surge in UK visitors during the first nine months of 2025, adding 120,000 more British tourists compared to last year.

India insurance plans offer big savings for NRIs in UAE: What’s driving demand

Lower premiums, tax perks, digital onboarding, and strong rupee-based protection are driving a surge in demand for India’s health and life insurance plans among NRIs in the UAE.

UAE shoppers to face card refusals after new Visa–Mastercard ruling in US?

A major US legal ruling against Visa and Mastercard may raise global card costs — and could eventually impact fees, rewards, and card acceptance for UAE shoppers.

Dubai gold hits Dh506 and the data shock from Washington could push it even higher

Dubai gold prices have surged toward Dh506 per gram, supported by global uncertainty and investors seeking safer assets. Analysts expect more gains if economic data from Washington triggers market fears.

Digital Dirham enters real use: What UAE residents should expect next

The UAE has completed its first government transaction using the Digital Dirham, marking the start of wider public use. Here’s what residents can expect next.

Mbank, EWIG transform UAE real estate payment with AE Coin

Mbank and EWIG partner to introduce AE Coin-powered blockchain payments for UAE real estate, enabling instant, secure, regulated, and low-cost property transactions.

UAE National Day: New hotels, high airfares spike staycation demand in Dubai

Hotel bookings across the UAE surge by 35% ahead of the National Day long weekend, driven by new hotel openings, rising airfares, and families choosing staycations over international travel.

Remit or hold? Indian rupee, Pakistani rupee, Philippine peso stay low in UAE

Asian currencies remain soft against the UAE dirham, giving expats more value for money transfers. Here’s a quick look at current exchange rates and what they mean for remitters.

UAE conducts first government transaction using Digital Dirham

The UAE has completed its first government-to-government payment using the Digital Dirham, marking a major step toward a fully digital economy and expanding the use of central bank digital currency (CBDC) nationwide.

World’s tallest hotel Ciel Dubai Marina to open November 15, rooms from Dh1,310

Ciel Dubai Marina, the world’s tallest hotel at 377 metres, opens on November 15, offering 1,004 luxury rooms with panoramic views and rates starting at Dh1,310 per night.

UAE approves new excise tax policy on sweetened drinks, sees high corporate tax compliance

The UAE Federal Tax Authority has approved a new sugar-based excise tax model for sweetened beverages while reporting over 651,000 corporate tax registrations, reflecting one of the world’s highest compliance rates.

UAE to start global sharing tax data on digital assets, cryptocurrencies by 2028

Starting in 2028, the UAE will begin exchanging tax data on digital assets and central bank digital currencies under OECD’s new global transparency standards, reinforcing its commitment to financial integrity and international cooperation.

How AI and immersive tech are redefining Dubai real estate

Dubai’s property market is undergoing a major digital shift — with AI, immersive technologies, and blockchain redefining how investors search, evaluate, and own real estate.

Dubai economy grows 4.4% to Dh241 billion in first half of 2025

Dubai’s GDP grew 4.4% to Dh241 billion in the first half of 2025, with strong gains across trade, tourism, construction, and real estate sectors, reinforcing progress toward the Dubai Economic Agenda (D33).

UAE, France to build 1-gigawatt AI data centre: What we know about this mega tech project

The UAE and France have joined forces to develop a €30–50 billion, 1-gigawatt AI data centre — Europe’s largest — marking a major milestone in international artificial intelligence cooperation.

Gold steadies in UAE after early November volatility

UAE gold prices remain stable after early November volatility as global traders weigh weak US jobs data and shifting interest rate expectations.

Gold steadies at Dh479.25 in UAE, traders gauge Fed outlook

Gold prices in the UAE remained unchanged on Thursday, with 24-karat gold at Dh479.25 per gram. The stability reflects investor caution as global traders await the US Federal Reserve’s next policy cues amid a slowing labour market and easing volatility.

Planning to buy gold this week? Prices steady near $4,000 with floor forming

Gold remains steady above $4,000 per ounce as traders watch for signs of a solid floor forming. Analysts suggest patience as the market consolidates after a strong rally, with long-term demand still supporting prices.

UAE launches first retail sukuk with Abu Dhabi Islamic Bank

The UAE Ministry of Finance partners with Abu Dhabi Islamic Bank (ADIB) to launch the nation’s first Retail Sukuk, allowing individuals to invest in Islamic Treasury Sukuk starting from Dh4,000 through ADIB’s fully digital “Smart Sukuk” platform.

New India airline refund rules proposed: Here’s how UAE travellers could benefit

India’s new airline refund and cancellation rules could benefit UAE-based travellers with 48-hour free cancellations, faster 21-day refunds, and free name corrections.

Abu Dhabi's NIP boosts Bitcoin mining output, now top private operator in MENA

NIP Group boosts its Bitcoin mining power to 11.3 EH/s, becoming the largest listed crypto miner in the MENA region as Abu Dhabi cements its role as a global digital infrastructure hub.

At Dubai airport, your face is your boarding pass when flying Emirates

Emirates passengers flying from Dubai can now use facial recognition to check in, pass immigration, enter lounges, and board flights — no passport or boarding pass needed.

What UAE retailers must do when applying new sugar-based tax on sweetened drinks, FTA explains

The UAE’s new excise tax on sweetened drinks will vary by sugar content starting 2026. The FTA urges businesses to obtain sugar content certificates early to ensure compliance.

New rules from November: What Indian expats in UAE need to know

From November 1, 2025, key financial changes in India will affect UAE-based Indians — including updates to bank nominations, Aadhaar, GST slabs, UPI access, and credit card charges.

New to Dubai? 8 smart home devices to make life easier in the UAE, 2025

New to Dubai? These eight smart home gadgets — from security cameras to smart plugs — will make your daily life safer, easier, and more connected in 2025.

Dubai leads record delegation to World Travel Market London 2025

Dubai is set to make a strong statement at World Travel Market (WTM) London 2025 with a record 71 partners, highlighting innovation, investment, and sustainability as part of its long-term tourism vision.

UK’s Petrofac collapse clouds multi-billion-dollar projects in UAE, GCC

UK energy firm Petrofac’s collapse raises uncertainty over multi-billion-dollar oil and gas projects across the UAE and GCC. Despite entering administration, regional analysts expect minimal long-term disruption to Gulf energy developments.

Dubai gold prices ease after record run. More declines ahead?

Gold prices in Dubai eased slightly following last week’s record-breaking surge, reflecting global market trends. Analysts say the correction may not be over yet as traders reassess US rate-cut expectations and improving global trade sentiment.

Why electric car insurance costs more in UAE — and when it can get cheaper

Electric vehicle (EV) owners in the UAE currently pay up to 35% more for car insurance due to high repair costs and limited service infrastructure — but experts say premiums will fall as the market matures and local expertise expands.

UAE Central Bank cuts key interest rate for second time in 2025, mirroring US Fed move

The UAE Central Bank lowers its base rate to 3.90% from 4.15%, following the US Federal Reserve’s latest interest rate cut, marking the second reduction in 2025 to support liquidity and economic growth.

Rents are finally dropping in Dubai — these areas just got more affordable

After years of rising prices, Dubai’s rental market is cooling off. According to Bayut’s Q3 2025 report, rents have dropped by up to 5% in several popular communities like Bur Dubai, Arjan, and Dubai Silicon Oasis, giving tenants long-awaited relief and signaling a more balanced property market.

Red Sea Global secures SAR6.5 billion green financing for AMAALA project

Red Sea Global (RSG) has obtained SAR 6.5 billion ($1.73 billion) in green financing from a consortium of Saudi banks, led by Riyad Bank, to accelerate the next phase of its ultra-luxury wellness destination, AMAALA. The move underscores investor confidence in Saudi Arabia’s sustainable tourism vision under Vision 2030.

Remit or hold? Indian rupee, Pakistani rupee, Philippine peso stay low in UAE

Indian rupee, Pakistani rupee, and Philippine peso remain low against the UAE dirham, offering UAE expats favorable remittance rates. Experts advise monitoring trends before deciding to remit or hold.

Emaar unveils Dubai Mansions, a Dh100 billion ultra-luxury community

Emaar unveils “Dubai Mansions,” a Dh100 billion ultra-luxury community featuring 40,000 upscale homes and grand estates between 10,000–20,000 sq ft, redefining elite living in Dubai’s newest master development.

Dubai gold price stays below Dh500 amid weaker haven demand and rate cut bets

Gold prices in Dubai slipped under Dh500 per gram amid global market weakness and easing safe-haven demand, as investors await a key US Federal Reserve rate cut decision.

Unified GCC Visa: What UAE travellers will pay compared to eVisa costs now

A new Unified GCC Visa, expected to launch soon, will allow UAE travellers to visit all six Gulf countries with a single permit, saving money compared to individual eVisa applications that currently range from Dh48 to Dh756.

Gold rates in Dubai to stay below Dh500 for now

After Diwali’s sharp correction, Dubai gold rates remain under Dh500 per gram, as global markets stabilize and investors reassess the metal’s record rally.

Dubai rent growth steadies as supply rises — buyers focus on apartments

Rising housing supply is cooling Dubai’s rent hikes, boosting apartment sales while villa demand steadies amid market maturity.

Emirates at 40: UAE airline’s journey beyond borders to 153 destinations

Marking its 40th anniversary, Emirates reflects on its journey from two leased aircraft in 1985 to a global network of 153 destinations, redefining modern aviation with innovation, service, and ambition.

US launches $1.8 billion fund with ADQ and Orion to secure critical minerals

The US has joined forces with Abu Dhabi’s ADQ and Orion Resource Partners to create a $1.8 billion investment fund aimed at securing global access to critical minerals vital for energy, defence, and advanced technologies.

Diwali 2025: How Dubai shoppers keep buying gold jewellery despite record prices

Despite gold crossing Dh510, Dubai’s festive shoppers are buying jewellery strategically, favouring lighter designs, instalment plans, and versatile pieces for Diwali and Dhanteras.

What is Dhanteras, and why is it an auspicious day to buy gold

Dhanteras marks the beginning of Diwali, symbolising wealth, health, and divine blessings. Buying gold, silver, and utensils on this day invites prosperity and positive energy into homes.

UAE gold prices hit an all-time high. What’s driving the surge?

Gold prices in the UAE have soared past Dh500 per gram, driven by geopolitical tensions, U.S. rate-cut expectations, and rising demand for safe-haven assets.

From farm stays to ‘set-jetting’ holidays, how UAE residents plan to travel next year

Expedia’s Unpack ’26 report reveals that UAE residents will prioritise meaningful, sustainable, and experience-driven travel next year — from farm stays and book retreats to film-inspired “set-jetting” and sports adventures.

Unified GCC Visa to change how UAE residents travel and insure trips

The upcoming Unified GCC Visa is set to transform how UAE residents travel and insure their trips. With seamless movement across six Gulf nations, the region’s travel insurance market is gearing up for a major shift toward broader, region-wide coverage plans.

Stake launches StakeOne, the region’s first fully digital investment solution for full property ownership

Dubai-based real estate platform Stake has unveiled StakeOne, a revolutionary digital solution allowing investors worldwide to buy, manage, rent, and sell entire properties in Dubai — all within one app.

Dubai residents turn buyers as home deals surge to Dh138 billion in Q3

Dubai’s property market surged to Dh138 billion in Q3 2025, driven by UAE residents purchasing homes to live in. Off-plan projects, family communities, and luxury villas fuelled strong growth across the emirate.

UAE gold inches closer to Dh500 mark after Dh9 jump in a day

Gold prices in the UAE surge by Dh9 in a single day, edging close to the Dh500 mark per gram as global tensions, U.S.-China trade worries, and interest rate cut expectations boost demand for the precious metal.

WeMasterTrade: Funded trading program for regional traders

WeMasterTrade launches a funded trading program offering Gulf traders a safe, risk-free way to learn financial markets using simulated accounts, Arabic-language support, and globally aligned trading education.

Dubizzle IPO: 5 reasons why Dubai's latest listing is expected to stand out

Dubizzle Group’s upcoming IPO on the Dubai Financial Market marks a major step for the UAE’s tech sector. With consistent revenue growth, narrowing losses, and renewed investor interest, the listing positions Dubizzle as a standout digital marketplace story in the region.

Fertiglobe ups 2025 shareholder payout to $277 million as earnings surge

Fertiglobe, backed by ADNOC and OCI Global, raises its 2025 shareholder returns to $277 million, driven by higher dividends, cost efficiencies, and AI-led operational gains.

Sharjah Award for public finance opens the Third Arab Financial Forum in Tangier

The Third Arab Financial Forum, organised by the Sharjah Finance Department and ARADO in Tangier, highlights regional collaboration and innovation in public finance management.

Dubai's DXB to hit maximum capacity by 2031 as new Al Maktoum airport plans take shape

DXB set to handle 115 million passengers by 2031 before full transition to Al Maktoum International in 2032

UAE NRIs: Thinking of investing back home? RBI just made it easier

Higher lending limits and simplified rules give overseas Indians greater access to India’s booming markets

US shutdown enters second week: What’s at stake for world economy?

As the US government shutdown stretches into its second week, economists warn of ripple effects across global trade, investor confidence, and financial markets.

When will gold prices in Dubai touch Dh500? Expert shares tips for buyers

As gold inches closer to Dh500 per gram in Dubai, experts reveal what could push it higher — and how buyers can shop smart amid soaring prices.

Remit now? Indian rupee and Philippine peso dip helps UAE expats

With the Indian rupee and Philippine peso dipping against the UAE dirham, expats find now a great time to send money home. Here’s what the latest exchange rates mean for you.

Dubai gold prices hit record highs amid US shutdown, looming Fed rate cut

Gold crosses $3,900 an ounce globally and hits fresh records in Dubai, with traders bracing for further gains amid US fiscal gridlock and rate-cut expectations.

Emirates NBD Securities opens GCC markets to UAE investors

Emirates NBD Securities expands access to all major Gulf stock markets, giving UAE investors seamless cross-border trading through a single platform.

Flying UAE–India? Emirates issues advisory to Dubai travellers on new travel rules

Starting October 1, 2025, non-Indian nationals flying from Dubai to India must complete a new digital e-Arrival Card before departure. Emirates warns travellers of possible delays if requirements are missed.

Must-haves in a UAE home: Top 6 features residents can’t live without

From balconies to shaded parking, UAE residents are reshaping property demand based on lifestyle needs, with Property Finder data highlighting the most-searched home features of 2024–2025.

From queues to clicks: Why expats in UAE are turning to digital remittances

Digital remittances are transforming how UAE expatriates send money home, replacing long queues and high fees with instant, transparent, app-based transfers.

Abu Dhabi’s economy grows 3.8% in Q2 2025, non-oil sector hits record high

Abu Dhabi’s real GDP rose to Dh306.3 billion in Q2 2025, with non-oil activities reaching their highest-ever value and accounting for more than half of the emirate’s economy for the first time.

Gold nears $4,000: When will prices drop next for buyers, investors?

Gold is closing in on the $4,000 per ounce mark, its highest ever, as inflation risks, fiscal spending, and safe-haven demand fuel the rally. Analysts warn a correction may take time, with any dips likely seen as buying opportunities.

Why a US government shutdown could shake the world economy

A political deadlock in Washington could disrupt global markets, from oil to currencies, with ripple effects felt in the UAE and beyond.

Dubai’s new offices to come with coffee- serving lifts, spas, treehouse meeting pods

HQ by Rove in Business Bay will bring hotel-style luxury to workspaces, with coffee-serving lifts, wellness facilities, and unique meeting pods.

UK tax exodus: Why more Britons are relocating to the UAE in 2025

As UK taxes rise and financial pressures mount, more Britons are relocating to the UAE in 2025 for tax-free earnings, security, and a better lifestyle.

Louis Philippe strengthens global presence with second Dubai store opening

Iconic menswear brand Louis Philippe has opened its second store in Dubai at BurJuman Mall, strengthening its international presence and catering to the Middle East’s growing demand for premium fashion.

UAE breaks into top 5 global crypto hubs; perfect tax score attracts digital millionaires

The UAE has entered the top five global crypto hubs, thanks to zero taxes on digital assets, strong regulations, and rapid blockchain adoption that continue to attract crypto millionaires worldwide.

Gold up Dh45 in 4 weeks, hits new high as UAE buyers brace for more gains

Gold surged Dh45 in just four weeks, reaching new highs in the UAE as global demand, Fed rate cuts, and central bank purchases fuel the rally.

Inside the orderly chaos of Dubai Mall’s iPhone 17, Pro Max, and Air launch in UAE

Apple’s iPhone 17 launch in Dubai drew long but orderly lines, with fans rushing for the Pro Max and iPhone Air, showcasing the brand’s unmatched hype power in the UAE.

Mubadala Bio names new CEO to drive global life sciences growth

Mubadala Bio has named Dr. Essam Mohamed as CEO and Hamad Husein Al Marzooqi as Deputy CEO, reinforcing its strategy to expand healthcare innovation and strengthen drug security worldwide.

GST rate changes in India start today: What Indian expats in UAE must know

India’s new GST 2.0 starts today with just two main slabs — 5% and 18%. Everyday items get cheaper, while luxury goods and tobacco move into a steep 40% bracket.

Heathrow airport cyberattack: Delays mount as Europe's air travel disrupted

A cyberattack on Collins Aerospace’s airline check-in system caused widespread delays at major European airports, forcing manual processing and flight cancellations in London, Berlin, and Brussels.

Sharjah gears up for Al Asayl Exhibition 2025 at Expo Al Dhaid

From September 25–28, Expo Al Dhaid will welcome over 250 brands for the Al Asayl Exhibition, showcasing equestrian, camel, and falconry products along with cultural heritage activities.

Dubai announces biggest-ever ‘Expand North Star’ with five new features for 2025 edition

Expand North Star 2025 will mark its 10th anniversary with five new features, including ScaleX, Green Impact, and the Digital Assets Forum, positioning Dubai as a global innovation hub.