Dubai: Gold prices drop further on last day of 2025 after record-breaking year

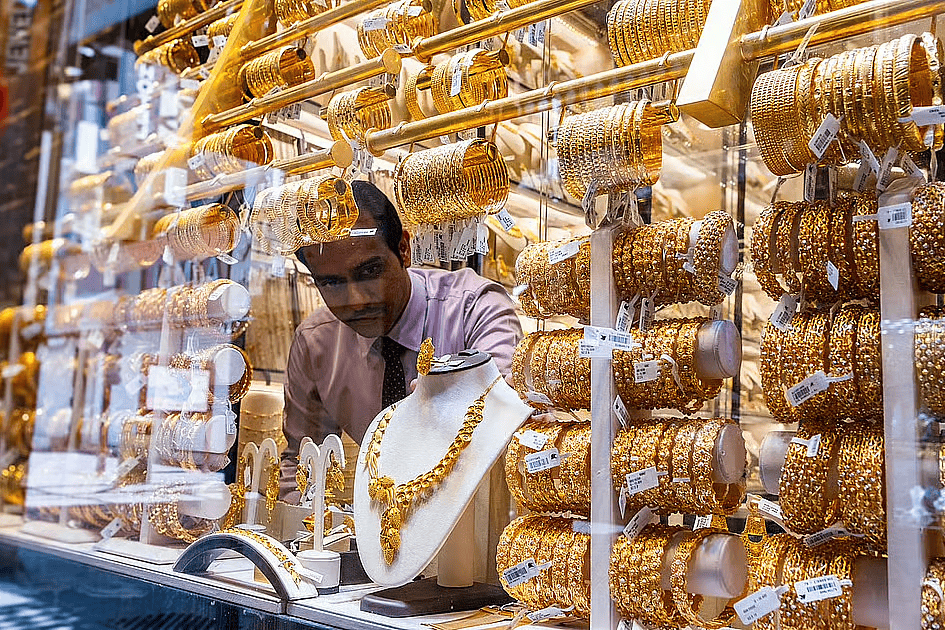

<p>Dubai gold prices declined further on the last trading day of 2025, marking a softer close to what has otherwise been a record-breaking year for the precious metal. Throughout 2025, gold witnessed exceptional growth, driven by global inflation concerns, geopolitical tensions, currency fluctuations, and strong demand from both investors and jewelry buyers.</p><p>The year saw gold prices in Dubai touch multiple all-time highs as investors turned to the metal as a safe-haven asset. Central bank purchases, reduced confidence in major currencies, and volatility in global equity markets all contributed to gold’s strong upward momentum. Retail demand in Dubai also remained robust, supported by the city’s reputation as a global gold trading hub and consistent tourist inflows.</p><p>However, as 2025 came to an end, prices experienced a noticeable pullback. Market analysts attribute this decline to profit-booking by investors, easing geopolitical tensions, and expectations of more stable monetary policies in major economies. A stronger US dollar toward year-end also added pressure on gold prices, making the metal slightly less attractive in the short term.</p><p>Despite the final-day dip, experts emphasize that gold’s overall performance in 2025 remains exceptionally strong. Long-term fundamentals continue to support the metal, with ongoing demand from central banks, investors seeking portfolio diversification, and sustained consumer interest in regions like the Middle East and Asia.</p><p>Looking ahead to 2026, analysts suggest that while short-term fluctuations may continue, gold is likely to remain a preferred investment option amid global economic uncertainties. For buyers in Dubai, the current price dip could present an attractive opportunity to invest or purchase jewelry after a historic year for gold markets.</p>