Loan sharks go digital: Pakistanis crushed by loan apps, social media scams

September 3, 2025 Dubai

Digital Loan Sharks Trap Pakistanis via Apps & Scams

Pakistan is cracking down on predatory loan apps and social media scams that trap citizens with sky-high interest rates, hidden charges, and blackmail tactics.

Pakistan Cracks Down on Predatory Loan Apps and Online Scams

Islamabad/Dubai: Pakistan is intensifying efforts to tackle predatory loan apps and digital scams that are exploiting vulnerable citizens. The Senate Standing Committee on IT and Telecommunications was briefed on alarming cases of online loan fraud, which continue to push Pakistanis deeper into financial distress.

According to the National Cyber Crimes Investigation Agency (NCCIA), some mobile loan apps charged interest rates as high as 1,800%, while misusing access to users’ phone galleries and contact lists to harass, threaten, and blackmail borrowers. Many victims borrowed as little as Rs5,000 for basic needs like food, only to get trapped in escalating debt cycles.

The Securities and Exchange Commission of Pakistan (SECP) initially licensed dozens of these companies in 2020 but has since tightened regulations, capping interest rates at 100% and banning apps from accessing personal data. While over 90% of fraudulent apps have been removed, scammers have now shifted to social media platforms like Facebook and TikTok, running ads for “instant loans” and disappearing after collecting upfront fees or sensitive information.

Earlier this year, SECP, with support from other agencies, shut down 141 unauthorized loan apps, yet loopholes persist, leaving low-income families particularly vulnerable. Victims often describe how small loans ballooned into massive debts through hidden charges, rollovers, and intimidation.

Digital rights experts warn that Pakistan’s low financial literacy and weak consumer protections make it fertile ground for such abuses. “These companies operate like loan sharks in people’s pockets,” said Nighat Dad from the Digital Rights Foundation.

The SECP is now reporting fake ads to the FIA and PTA, urging citizens to verify lenders against its official list of licensed companies. However, without stricter monitoring and stronger redress systems, many Pakistanis remain at risk of falling into the digital debt trap.

Abu Dhabi Motorists Face Dh1,000 Fine and 10 Black Points for Failing to Stop for School Buses

Abu Dhabi enforces strict penalties on drivers who fail to stop for school buses, prioritizing student safety on roads.

Economics: Guiding Resource Use and Shaping National Growth

Economics explains how resources are allocated, decisions are made, and national growth is achieved efficiently.

UAE Updates Civil Procedures Code: New Rules on Inheritance Disputes & Expert Reports

The UAE has amended its Civil Procedures Code to streamline inheritance dispute resolution and strengthen the use of expert reports in civil litigation, boosting judicial efficiency and accuracy.

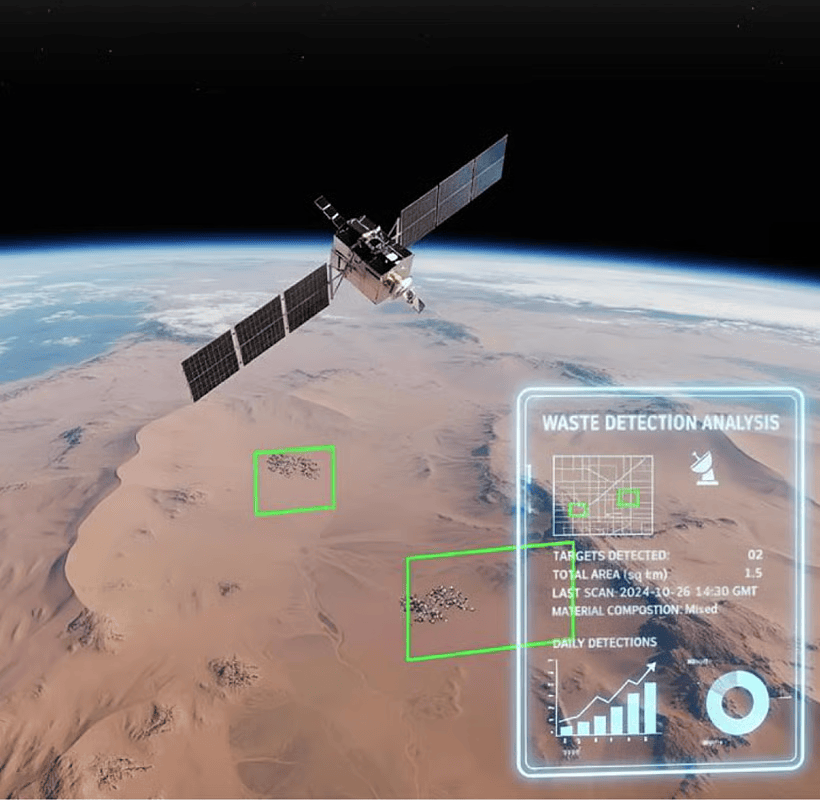

Abu Dhabi Launches Satellite‑Driven Pilot to Detect Illegal Waste Dumping

Abu Dhabi’s Environment Agency has launched an innovative pilot project using satellite imagery and AI to detect illegal waste dumping sites across the emirate, significantly improving environmental monitoring and waste management.

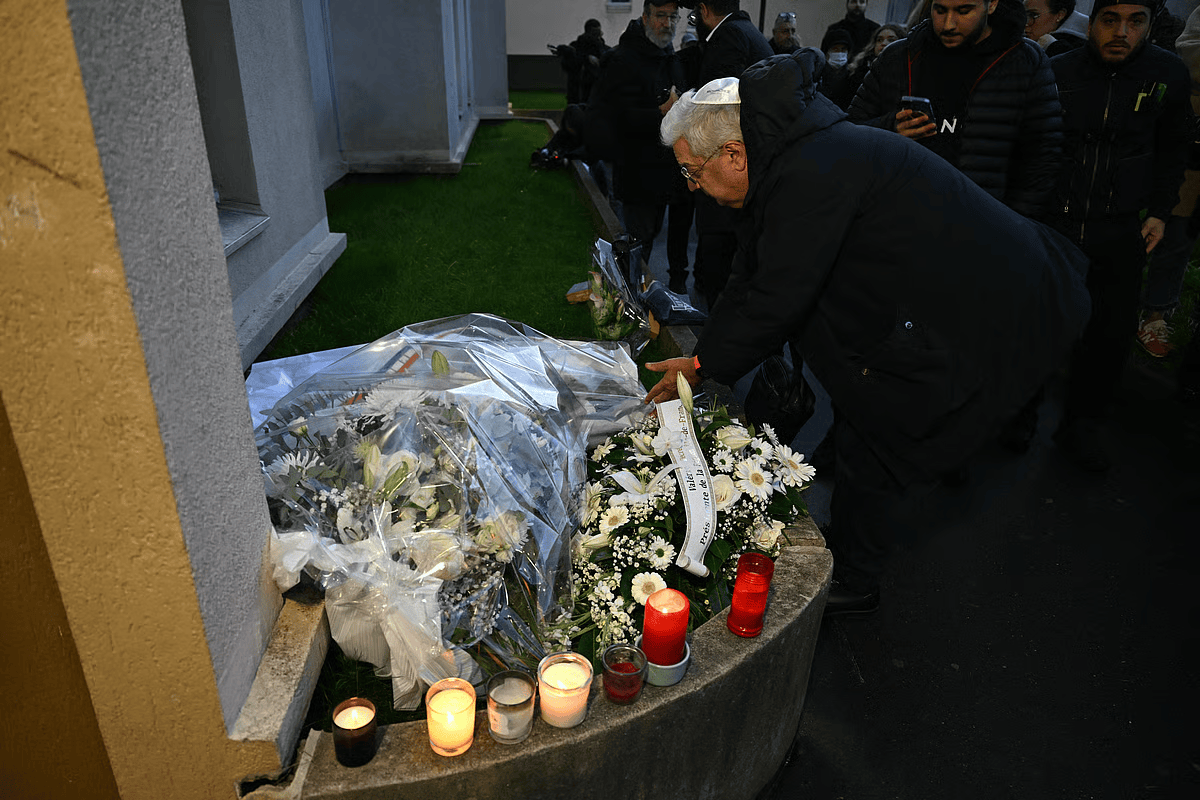

Bondi Beach Shooting Victims: Here’s What We Know About 13 of Those Killed

The tragic Bondi Beach shooting claimed multiple lives and shocked Australia and the world. Authorities have confirmed details about 13 of the victims as investigations continue. This article summarizes verified information released so far, focusing on the victims, official responses, and the broader impact of the incident.

UAE Traffic Alert: Heavy Delays on Key Dubai Routes Including E11 and E311 Road

Motorists in Dubai are facing heavy traffic delays on major routes such as E11 Sheikh Zayed Road and E311 Sheikh Mohammed Bin Zayed Road due to peak-hour congestion and increased vehicle movement. Authorities advise commuters to plan alternate routes and allow extra travel time.

UAE weather: Alerts issued for rain, rough sea; lowest temperature 22ºC in Dubai

As unstable weather continues in the UAE, residents can expect partly cloudy to cloudy skies on Monday, December 15, 2025. The National Centre of Meteorology (NCM) has predicted rainfall over some eastern, northern and coastal areas as well.

Amazon UAE Prime members can now enjoy free fuel delivery with CAFU

Amazon Prime members in the UAE can now enjoy up to seven free monthly fuel deliveries through a new partnership with CAFU, offering convenience and up to Dh400 in annual savings.

How UAE ministry de-accredited university misused local office

A Fujairah-based office of Midocean University was found to have exceeded its licensed scope by running unaccredited academic programmes, prompting the UAE Ministry of Higher Education to withdraw recognition of its qualifications.

UAE's eighth aid aircraft lands in Sri Lanka, delivering vital relief supplies

An eighth UAE humanitarian aircraft has landed in Sri Lanka delivering 1,080 food parcels, reinforcing ongoing relief and recovery efforts following severe floods and landslides.

Trump says US will allow sale of Nvidia AI chips to China

Former US President Donald Trump says Washington will allow Nvidia to export advanced H200 AI chips to approved Chinese customers, marking a major shift from Biden-era restrictions and reshaping the global AI technology race.

Dubai nights glow again as DSF Drone Shows begin

The Dubai Shopping Festival 2025 begins with dazzling nightly drone performances over Bluewaters and JBR, featuring more than 1,000 advanced drones, synchronised Ain Dubai lights, and all-new pyro effects.

AI Alliance Network expands globally with launch of landmark report

The AI Alliance Network has expanded to 28 organisations across 21 countries, marking its global rise with the launch of the landmark AI Horizons report on the future of artificial intelligence.

Saudi IPO pipeline expands toward 100 approvals despite 12% fall in Tadawul benchmark

Saudi Arabia’s IPO pipeline is expanding toward 100 potential listings in 2025, even as the Tadawul index slips, reflecting ongoing reforms and efforts to deepen capital markets.

UAE National Day marked with dazzling celebrations nationwide

Fireworks, cultural performances, and patriotic displays lit up cities across the UAE as residents and visitors came together to celebrate the nation’s 54th National Day with pride and joy.

Cyber Monday deals: iPhone 15, 16 and MacBook Pro hit lowest UAE prices, 6 more top offers

Cyber Monday has arrived in the United Arab Emirates with major price cuts on Apple devices and more. From the latest iPhones to MacBooks, smart home appliances, and premium audio gear, Amazon is offering some of the best tech deals of the year.

UAE conveys solidarity as cyclone batters Sri Lanka

The UAE has expressed solidarity with Sri Lanka following a devastating cyclone, offering condolences to affected families and reaffirming support amid widespread loss and destruction.

Is the Trump–Xi Busan breakthrough a real détente or a pause?

Agreements on fentanyl controls and rare earths marked progress at the Trump–Xi meeting in Busan, but past volatility and strategic rivalry raise questions about whether the thaw will last.

New school opening: 450-year-old Rugby School from UK is coming to Dubai

The 450-year-old Rugby School from the UK is set to launch its first Middle East campus in Dubai, taking over Kent College Dubai’s Nad Al Sheba site from the 2026–2027 academic year.

UAE National Day alert: Double absence rule for students missing school after Eid Al Etihad holidays

UAE students missing school on December 3, 4 and 5 after Eid Al Etihad will face double-counted absences unless they have valid excuses, education authorities have warned.

UAE National Day 2025: Where to watch the Eid Al Etihad parades

From Dubai to Fujairah, Eid Al Etihad 2025 parades, fireworks, and public screenings will bring the UAE together to celebrate 54 years of unity and nationhood.

Why the UAE must build its own orbital access capability

As AI, data demand, and global competition intensify, experts say the UAE must develop its own orbital launch capacity to secure its future technological and economic strength.

Dubai gold price firms up to Dh499.75 on strong bets for a December Fed rate cut

Dubai gold prices climb to Dh499.75 as traders boost expectations of a December US Fed rate cut amid weakening economic data.

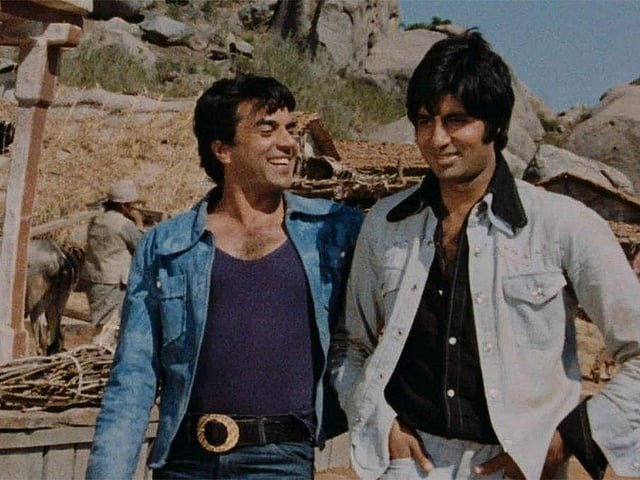

Amitabh Bachchan’s heartfelt farewell to his Sholay co-star Dharmendra and their deep friendship

Amitabh Bachchan pays a heartfelt tribute to his Sholay co-star and close friend Dharmendra, who passed away at 89, remembering a rare friendship admired across generations of Indian cinema.

Remit or hold? Indian rupee, Pakistani rupee, Philippine peso stay weak in UAE

Asian expats weigh the best time to send money home as the Indian rupee, Pakistani rupee and Philippine peso remain near multi-year lows against the UAE dirham, opening strong remittance opportunities.

Dubai Run 2025: Indian expat runs 23km from Al Qusais to DIFC

Indian expat and mountaineer Nasar Husain ran 23km from Al Qusais to DIFC at dawn before joining thousands of Dubai Run 2025 participants, as part of his personal challenge to complete 30 half marathons in 30 days.

Remit or hold? Indian rupee, Pakistani rupee, Philippine peso stay weak in UAE

With the Indian rupee, Pakistani rupee and Philippine peso trading near multi-year lows against the UAE dirham, expats weigh the best strategy for remittances—send now or wait for further movement.

Miss Universe 2025 drama deepens: Was contest rigged? Dubai's Miss Palestine Nadeen Ayoub calls out 'unjust' public polling

Miss Palestine Nadeen Ayoub has raised serious concerns over an abrupt vote surge in the Miss Universe 2025 app poll, calling the process “unjust” and demanding transparency after a dramatic last-minute shift.

Great crypto crash: $1 trillion wiped out as Bitcoin plunges anew

Bitcoin has plunged to its lowest level in seven months as the 2025 crypto crash deepens, wiping out more than $1 trillion from the global digital-asset market.

Nvidia, Microsoft invest $15 billion in AI startup Anthropic

Nvidia and Microsoft are investing a combined $15 billion in Anthropic, marking one of the biggest deals in the booming AI industry and signaling a major shift in the competitive landscape.

After sudden death of Indian doctor in Abu Dhabi, her unpublished book ‘How Many More Days’ reaches readers

Months after the unexpected passing of Indian dentist and writer Dr Dhanalakshmi in Abu Dhabi, her family has published her unfinished poetry collection ‘How Many More Days’, offering a moving glimpse into her final reflections.

Dubai gold steadies at Dh485.75 with traders bracing for the next policy signal

Gold prices in Dubai held steady at Dh485.75 for 24K as global traders reduced expectations of a December US rate cut, keeping the bullion market cautious.

How to check if you need a UAE visa before travelling

More than 80 nationalities can enter the UAE visa-free. Here’s how to quickly check your visa eligibility using the official MOFA online tool.

Free AI courses in UAE for students and adults to boost careers

Free AI courses, Google Gemini Pro access, and virtual tech camps are helping UAE residents develop in-demand AI skills for future careers.

UAE: Don’t let AI make students lazy, warns World Schools Summit founder

Vikas Pota, founder of the World Schools Summit, urges educators to keep teachers at the center of AI adoption and warns against students becoming overly dependent on technology.

Abu Dhabi BAPS temple head urges medical community to ‘ReInvent’

Swami Brahmaviharidas, head of the Abu Dhabi BAPS Hindu Mandir, addressed more than 700 medical professionals in Georgia, urging them to embrace purpose, resilience, and compassion in healthcare.

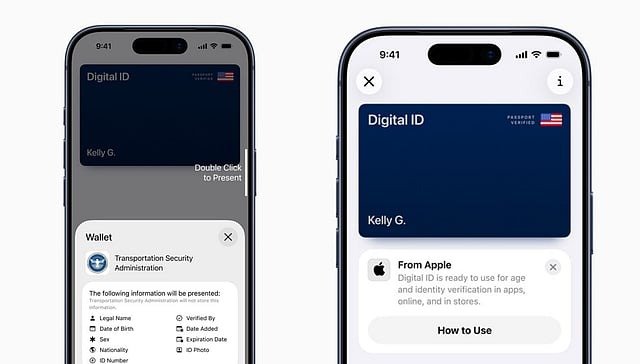

iPhone users can now add US passport to Apple Wallet: How secure is the new Digital ID?

Apple’s new Digital ID feature lets iPhone users scan and store their US passport in Apple Wallet for TSA screening at over 250 airports — but only for domestic travel.

UAE National Day: Will the public holiday be a four-day or five-day break

The UAE’s final public holiday of 2025 — Eid Al Etihad — falls on December 2 and 3. Here’s whether residents can expect a 4-day or 5-day long weekend.

Video: Sheikh Khaled meets Kerala Chief Minister Pinarayi Vijayan in Abu Dhabi

Sheikh Khaled bin Mohamed bin Zayed and Kerala Chief Minister Pinarayi Vijayan held talks in Abu Dhabi to boost cooperation in trade, investment, innovation, and development.

New private astronaut training Centre set to open in UAE

A new private Human Spaceflight Training Centre in the UAE will prepare astronauts, drive research, and support future orbital missions, marking a major milestone for the region’s space ambitions.

Yamaha unveils next-gen AI motorcycle at Japan Mobility Show

Yamaha introduces its next-generation AI motorcycle, MOTOROiD λ (Lambda), alongside hydrogen and electric mobility innovations at the Japan Mobility Show.

Honda successfully tests reusable rocket, a huge step in its aerospace ambitions

Honda has achieved a major aerospace milestone by testing a reusable rocket in Hokkaido, Japan. The experimental rocket reached 271.4 meters and landed within 37 cm of its target, marking a key step in the company’s space ambitions.

Inside SARA: How UAE’s young minds are getting ready for space and beyond

At the relaunch of Dubai’s Space and Rocketry Academy (SARA), young innovators got hands-on with space, AI, and sustainability — proving that curiosity is the UAE’s strongest launch fuel for the future.

Buy a gold-plated iPhone in Dubai for Dh11,111 in 11.11 sale

As the 11.11 sale fever hits the UAE, retailers are offering jaw-dropping deals — from a 24-karat gold-plated iPhone for Dh11,111 to electronics discounts of up to 50% across major brands.

UAE unveils strategic vision to cement global leadership at Landmark Press Conference

The UAE held its first International Press Conference, unveiling a strategic roadmap to reinforce global leadership across investment, AI, and innovation. The government also launched major digital economy initiatives to boost talent, startups, and future skills.

TRENDS and Cambridge Artificial Intelligence collaborate to empower youth in AI

TRENDS Research and Advisory has partnered with Cambridge Artificial Intelligence to host an intensive AI summer program at the University of Cambridge in 2026, empowering exceptional students aged 16–18 from the UAE and GCC with advanced skills in innovation, ethics, and technology.

Asking ChatGPT for medical advice? Dubai doctors share real-life, shocking cases

Dubai doctors share shocking real-life cases where patients relied on ChatGPT for medical advice — leading to wrong treatments, worsening infections, and life-threatening delays. Experts urge users to consult professionals instead of self-diagnosing through AI.

From Osaka with gratitude: How the UAE Pavilion became a bridge of friendship at Expo 2025

UAE Ambassador to Japan Shihab Alfaheem reflects on how the UAE Pavilion at Expo 2025 Osaka became a symbol of connection, curiosity, and cultural harmony — welcoming over five million visitors and strengthening ties between the UAE and Japan.

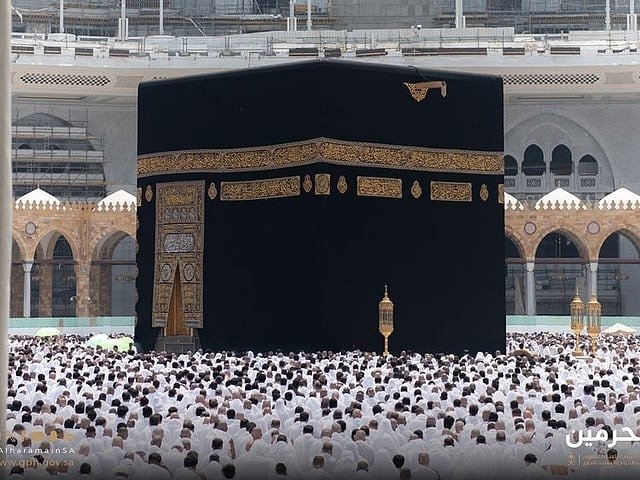

Umrah 2025: Key rules UAE residents need to know before travelling to Saudi Arabia

From visa validity and mandatory hotel bookings to vaccination requirements and land travel regulations — here’s everything UAE residents need to know before performing Umrah in 2025.

Indian Sikh pilgrims cross into Pakistan for Guru Nanak's birth anniversary celebrations

Over 2,000 Sikh pilgrims from India crossed into Pakistan through the Wagah border to celebrate Guru Nanak’s 556th birth anniversary at his birthplace in Nankana Sahib, marking the first major crossing since the border closure in May.

Miss Universe 2025: Ahtisa Manalo arrives in Thailand, eyes 5th crown for Philippines

Miss Universe Philippines 2025, Ahtisa Manalo, landed in Bangkok to a warm and emotional welcome as she sets her sights on winning the Philippines’ fifth Miss Universe crown at this year’s pageant.

5 major Dubai changes you need to know about in November

From new transport updates to visa rule changes and major events, here are five big developments shaping life in Dubai this November 2025.

More than 53,000 new companies joined Dubai Chamber of Commerce during first nine months of 2025

During the first nine months of 2025, the Dubai Chamber of Commerce welcomed 53,838 new member companies, signalling a 4% year-on-year growth and reinforcing Dubai’s standing as a global business hub.

Why Anushka Sharma’s cricket biopic has been on hold for over 2 years—now more relevant after World Cup win

Anushka Sharma’s long-delayed cricket biopic Chakda ’Xpress faces streaming disputes despite India’s historic Women’s World Cup win making the film more relevant than ever.

Dubai leads record delegation to World Travel Market London 2025

Dubai will showcase innovation, sustainability, and investment at WTM London 2025, leading a record 71-partner delegation to strengthen its position as a top global tourism hub.

UAE petrol prices for November out today: Will it rise or drop?

As the UAE prepares to announce November’s fuel rates, global oil volatility and easing tensions could influence whether prices drop or remain stable.

Abu Dhabi among the world’s top 20 smart cities

Abu Dhabi earns global recognition as a top 20 smart city, blending AI innovation and sustainability with a human-centered approach to enhance residents’ quality of life.

Indian ePassport with chip in UAE: Should all Indian expats change their regular passports now?

Indian missions in the UAE launch chip-enabled ePassports, offering stronger security and faster immigration — but replacing your old passport isn’t mandatory yet.

Mastercard, Visa cardholders in UAE: Soon, AI will shop for you — and pay with your money

Mastercard and Visa are launching AI-powered payment systems in the UAE that can shop, decide, and pay automatically — securely using your card within set limits.

Dubai ranked among world’s top four fintech hubs in global index

Dubai has been recognized as one of the world’s top four FinTech hubs in the latest Global Financial Centres Index (GFCI), reflecting its rise as a global leader in finance, innovation, and technology through the Dubai International Financial Centre (DIFC).

UAE Lottery Dh100 million jackpot winner reveals how he won and what he will do

29-year-old Abu Dhabi resident Anilkumar Bolla wins the UAE Lottery’s record Dh100 million jackpot, credits his mother’s birthday for the lucky number, and vows to fulfill his parents’ dreams while giving back to those in need.

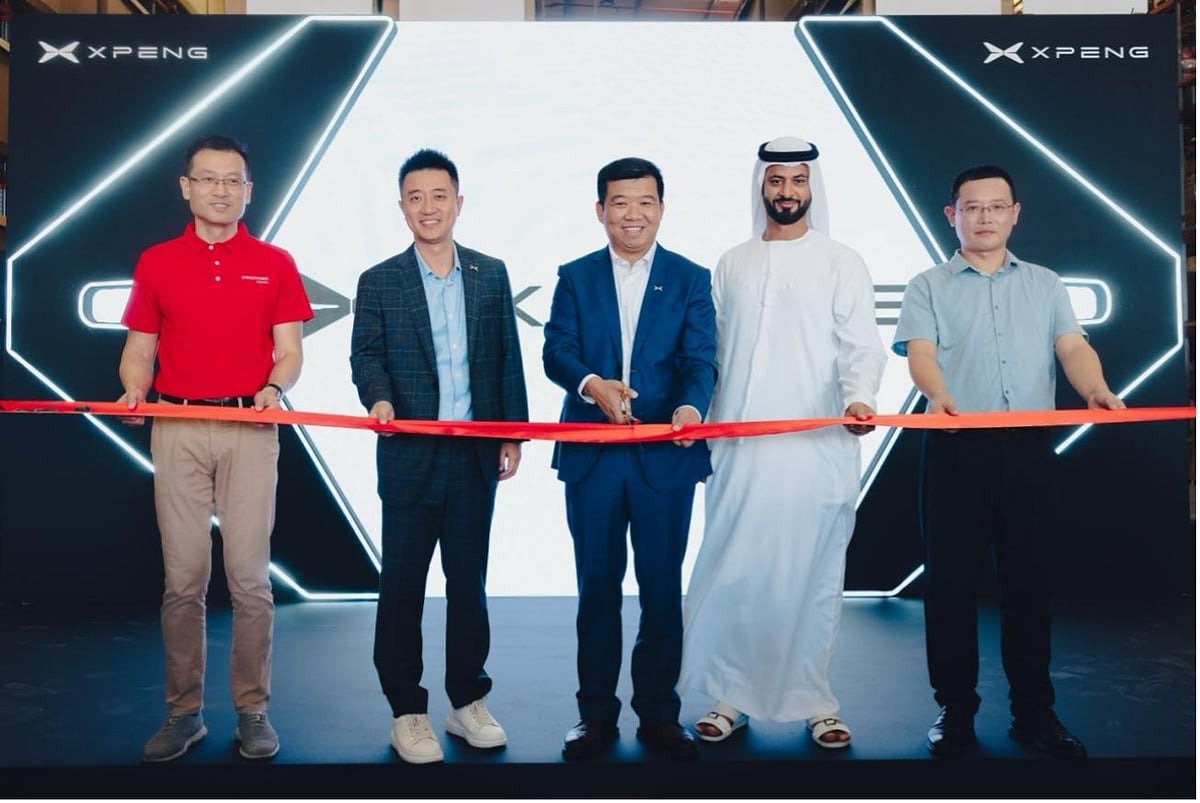

XPENG boosts Middle East presence with cutting-edge Dubai spare parts warehouse

XPENG strengthens its Middle East footprint with a new, tech-driven spare parts warehouse in Dubai, built in partnership with JD Logistics to enhance EV service efficiency and customer satisfaction.

Hindi surprise from UAE minister wins hearts at India event in Dubai

UAE Minister of State Noura Al Kaabi delighted more than 100,000 attendees at Dubai’s “Emirates Loves India” event with a heartfelt Hindi greeting, highlighting the deep cultural and emotional bond between the UAE and India.

100,000+: Dubai’s Zabeel Park rocks with ‘UAE’s largest Indian party’

More than 100,000 people gathered at Dubai’s Zabeel Park for the “Emirates Loves India” festival — a spectacular celebration of Indian music, culture, and unity. The mega event showcased UAE-India friendship with star performances, cultural displays, and community spirit.

Remit or hold? Indian rupee, Pakistani rupee, Philippine peso stay low in UAE

The Indian rupee, Pakistani rupee, and Philippine peso remain low against the UAE dirham, giving expatriates more value for money when sending remittances home. As of October 27, 2025, the trend continues to favor remitters, though uncertainty remains about whether to remit now or hold off for better rates.

Dubai Police make 3-year-old's dream come true with uniform and luxury patrol ride

In a touching act of community engagement, Dubai Police made three-year-old Sara Nabil Ahmadi’s dream come true by gifting her a police uniform and a ride in their iconic luxury patrol car.

Indian expat family in UAE told how Dubai student, 18, died during Diwali celebration

Dubai Police confirm that 18-year-old Indian student Vaishnav Krishnakumar died of natural causes during a Diwali celebration, with the forensic report citing sudden cardiac arrest.

Dubai's RTA to launch smart traffic system linking signals to vehicles

Dubai’s RTA is launching a V2X network linking traffic signals to vehicles, delivering real-time road data to dashboards, reducing congestion, and enhancing safety by 2028.

RTA announces online auction for special Dubai plate codes

Dubai’s Roads and Transport Authority (RTA) is hosting its 81st online auction offering 300 premium three, four, and five-digit plate codes across multiple series, starting November 3.

How NRIs can add local UAE address to their Indian passport

Indian expatriates in the UAE can now include their local UAE address in their Indian passports by applying for a reissued passport through BLS International or the Passport Seva portal.

More UAE residents look to invest in crypto as confidence grows worldwide

With global confidence in cryptocurrencies rising, more UAE residents are investing in digital assets, supported by strong regulation, secure exchanges, and growing awareness.

Weekend Digest: New UAE customs rules, BLS alert, Pakistan’s passport slip and more

From new UAE customs rules and AI policing to BLS passport alerts and global travel updates — here’s your weekend roundup of the most talked-about news across the UAE and beyond.

Abu Dhabi launches smart system to catch misuse of PoD parking

Abu Dhabi rolls out a smart parking verification system to stop unauthorised use of People of Determination (PoD) spaces, promoting accessibility and inclusion.

A new flagship dawn: OPPO’s Find X9 & X9 Pro emerge with ColorOS 16

OPPO unveils its flagship Find X9 series featuring pro-grade cameras, massive batteries, and ColorOS 16 for smarter, smoother performance.

Ishan Shivanand's bestseller on Ancient Resilience Protocols debuts in Dubai

Ishan Shivanand’s The Practice of Immortality, a guide to ancient resilience protocols, launches in Dubai, offering readers techniques for mindfulness, health, and mental resilience.

UAE honours Pakistan envoy with prestigious First-Class Order of Zayed II

Pakistan’s Ambassador to the UAE, Faisal Niaz Tirmizi, receives the prestigious First-Class Order of Zayed II in recognition of his efforts to strengthen UAE–Pakistan ties.

Big win for Indian expats in UAE as Air India Express reinstates Kerala flights in winter schedule

In a major relief for Indian expats in the UAE, Air India Express reinstates key Kerala flights in its winter schedule after community groups and MPs raised concerns over planned cancellations.

After 15 years in Dubai, Bangladeshi worker wins Big Ticket Abu Dhabi

Bangladeshi expat Alim Uddin Sonja Miah, who spent 15 years working in Dubai’s loading industry, wins Dh85,000 in Big Ticket Abu Dhabi, sharing his prize with 10 friends.

What to expect at Global Village reopening as CEO reveals ambitious plans for new season

Global Village reopens for its milestone 30th season, promising a longer run, major celebrity appearances, and unbeatable value for visitors, says Dubai Holding Entertainment CEO Fernando Eiroa.

Trump hails 'martyr' Charlie Kirk at posthumous medal ceremony

At a solemn White House ceremony, President Donald Trump awarded the late conservative activist Charlie Kirk the Presidential Medal of Freedom, calling him a “martyr for truth and freedom” and vowing to intensify his crackdown on radical left-wing groups.

SCA and VARA partner to strengthen virtual asset rules, oversight in UAE

The UAE’s Securities and Commodities Authority (SCA) and Dubai Virtual Assets Regulatory Authority (VARA) have partnered to establish a unified framework for overseeing virtual assets, enhancing investor protection, innovation, and transparency across the nation.

'I am good at solving wars': Trump

US President Donald Trump says he can resolve the border conflict between Pakistan and Afghanistan, calling it his “eighth war solved” as he heads to Egypt for the Gaza peace summit.

When a dream car turns into a scam: Sharjah Police issue fraud alert

Sharjah Police urge residents to verify sellers and report suspicious advertisements as online scams offering “dream cars” at low prices continue to rise.

Storm destroys cargo during voyage in UAE. Can charterer refuse to pay full freight?

A UAE maritime law expert explains when a shipowner is liable for cargo damage caused by natural forces and whether the charterer can legally withhold freight payment after a storm.

India emerging as a global hub for AI and fintech innovation: SC Ventures

Standard Chartered’s SC Ventures executives highlight India’s growing leadership in artificial intelligence, blockchain, and fintech, calling it a “gold mine” of talent and innovation driving global transformation.

Tesla offers cheaper versions of 2 EV models in bid to win back market share in tough year

New $40K Model Y and $37K Model 3 target budget-conscious buyers as Tesla faces fierce EV competition

ChatGPT can hallucinate: College dean in Dubai urges students to verify data

AI literacy, ethics, and academic integrity must be core skills for future doctors, says Dr. Wafaa Al Johani

Remit now or wait? UAE expats gain on rupee, peso

Asian currencies including the Indian rupee and Philippine peso have weakened against the UAE dirham, creating a golden window for remittances. But should expats send money now — or wait for rates to climb further?

Dubai resident wins Big Ticket prize after 25 years in UAE

After 25 years in the UAE and countless Big Ticket attempts, Dubai resident Chucri Helayel finally struck luck — winning Dh50,000 in the weekly e-draw. His story is one of patience, hope, and never giving up on a dream.

DEWA, Dubai Taxi ink long-term deal for ultra-fast EV charging stations

Dubai Electricity and Water Authority and Dubai Taxi Company have signed a landmark deal to deploy 208 ultra-fast EV charging stations, supporting fleet electrification and cutting nearly 50,000 tonnes of carbon emissions annually.

Indian mum’s tearful wish for son comes true with Dh100K Big Ticket

Sharjah resident Vineetha Shibu Kumar, a behaviour therapist and mother of a son battling epilepsy, wins Dh100,000 through the Dear Big Ticket initiative, bringing hope for her son’s dream of becoming a criminologist.

UAE court orders airline to pay passenger Dh10,000 over faulty seat

An Abu Dhabi court has ordered an airline to pay Dh10,000 in damages to a passenger injured by a malfunctioning seat mid-flight, ruling that the airline compromised her physical safety and caused emotional distress.

Abu Dhabi to get light rail, urban loop transport soon

Abu Dhabi has announced two landmark transport projects—the Light Rail and Urban Loop—aimed at creating a sustainable, integrated, and modern mobility network by 2030.

BMW warns thousands of owners: Park cars outside to avoid fire risk

BMW has issued an urgent global recall affecting over 331,000 vehicles, citing a starter motor defect that could cause short circuits and fires.

Cheese-ing the moment! Amul toasts Mohanlal’s Phalke glory

Dairy giant Amul celebrates Mohanlal’s Dadasaheb Phalke Award with a witty cartoon, blending humour, respect, and its iconic “utterly butterly” charm.

Predicted UAE public holidays 2026: Likely Eid dates and long weekends

UAE residents can expect 12 public holidays in 2026, including Eid Al Fitr and Eid Al Adha. Astronomical forecasts suggest a possible six-day long weekend.

Remit now? New money exchange rates for India rupee, Pakistan rupee, Philippine peso

Asian currencies weaken, giving UAE expats better remittance value. Latest dirham rates: INR 24.07, PKR 76.67, PHP 15.65. Should you remit now?

Dominant India beat Bangladesh to maintain clean slate in Asia Cup

India stormed into the Asia Cup 2025 final with a dominant 41-run win over Bangladesh, extending their unbeaten streak and showcasing all-round brilliance.

Drivers beware, heavy traffic on E311 and E44 roads causes major delays

Motorists face major delays on Dubai’s E311 and E44 roads due to heavy congestion and dense fog. Abu Dhabi Police have implemented temporary speed limits to ensure road safety.

UAE's ALEC sets IPO price range as Dubai pushes ahead with landmark listing

UAE’s ALEC Holdings sets Dh1.35–1.40 per share for its IPO, marking a significant listing on the Dubai Financial Market. Subscription runs from September 23 to 30, with trading starting October 15.

Sam Altman on AI and jobs: Who’s safe and who’s at risk

OpenAI CEO Sam Altman shares his views on how artificial intelligence could reshape the job market, highlighting which professions face the greatest risk of automation—and which roles will remain safe.

Asia Cup: India look to fine-tune Super Four preparations against Oman

India, already through to the Super Four after dominant wins over UAE and Pakistan, face Oman in their final group-stage match. While Oman seek respect in their debut campaign, India look to fine-tune their middle order and manage player workloads ahead of bigger clashes.

UAE weather: Slight dip in temperatures with fog and mist expected in coastal areas

The UAE is set to experience slightly cooler mornings with fog and mist in coastal areas, partly cloudy skies, and possible rainfall in eastern regions, while temperatures remain high inland.

Asia Cup: Pakistan need to shut out the noise against UAE

After a crushing defeat to India, Pakistan must regroup quickly for a must-win encounter against a confident UAE side eyeing a historic place in the Super Four.

Dubai to get region’s first US-style four-year medical school at AUD

The American University in Dubai (AUD), in partnership with Penn Medicine, has announced the launch of the Middle East’s first US-style four-year medical school, set to open in 2027.

Dubai Fountain to open early? Emaar clarifies

Despite social media buzz showing the Dubai Fountain basin filled with water, Emaar has confirmed that the attraction’s reopening date remains unannounced and renovation works are continuing as planned.

Accident causes delays on Umm Suqeim street near Dubai Police Academy

A traffic accident on Umm Suqeim Street near the Dubai Police Academy has led to heavy congestion. Dubai Police urge motorists to drive cautiously and consider alternative routes to avoid delays.

Sharjah Police, National Guard airlift injured motorcyclist after crash

A motorcyclist injured in a desert crash near Al Madam was swiftly rescued and airlifted to safety, thanks to seamless coordination between Sharjah Police and the UAE’s National Guard.

Guardians of blue and green: How the UAE’s protected areas safeguard aquatic life

The UAE’s protected areas safeguard seagrass meadows, wetlands, coral reefs, and mangroves, ensuring biodiversity, food security, and climate resilience while blending tradition with innovation.

How the UAE is using AI for cloud seeding

The UAE is using artificial intelligence to power cloud seeding, monitor ecosystems, improve food security, and drive sustainability as part of its National AI Strategy.

New KHDA rules for teachers to enhance quality, stability, say Dubai schools

KHDA’s new teacher appointment and deregistration rules, including the 90-day resignation rule, aim to improve education quality, teacher accountability, and student safety in Dubai schools.

Will Asia Cup 2025 final see it's first-ever India-Pakistan clash?

India and Pakistan have never faced off in an Asia Cup final despite 17 editions since 1984. With both teams in strong form ahead of their September 14 clash in Dubai, fans hope 2025 could make history.

From daily jobs to cement wickets to Asia Cup, inspiring journey of Oman cricketers

From cement wickets to facing cricketing giants, Oman’s cricketers have battled struggles and sacrifices to reach the Asia Cup 2025.

UAE weather alert: Dense fog in Abu Dhabi, NCM urge caution amid low visibility

Thick fog blanketed Abu Dhabi on Wednesday morning, prompting warnings from the NCM and Abu Dhabi Police. Motorists are urged to follow speed limits, drive cautiously, and use fog lights to ensure safety.

Son of Indian expat jeweller in UAE dies of sudden cardiac arrest in Dubai

Jacob Palathumpattu John, 46, executive director of Sky Jewellery and son of chairman Babu John, passed away in Dubai after a sudden cardiac arrest.

Trump, Modi optimistic as US-India trade negotiations continue

US President Donald Trump and Indian PM Narendra Modi expressed optimism as trade talks continue, calling both nations “close friends and natural partners.”

How to apply for the UAE Green Visa for skilled workers

The UAE Green Visa allows skilled professionals to live and work in the country for five years with added benefits. Learn about eligibility, documents, fees, and the step-by-step application process.

What is the minimum age to start a business in the UAE?

The UAE has reduced the minimum age for business ownership from 21 to 18. Here’s a full breakdown of age requirements for company setup, crowdfunding, and trade approvals.

UAE internet outage: What's the real story behind the Red Sea cable cuts?

Several subsea cable cuts in the Red Sea have disrupted internet speeds across the UAE. Experts warn the outage highlights the region’s reliance on fragile digital corridors and the urgent need for alternative routes.

US, UAE set to cut interest rates next week: How it affects your savings, loans

The US Federal Reserve and UAE Central Bank are set to lower interest rates next week. Find out how this shift could affect savings, loans, mortgages, and investment opportunities for UAE residents.

6 reasons new US visa interview rule matters if you live in UAE

From stricter location rules to non-refundable fees, here’s why the new US visa interview policy affects every UAE resident applying for travel to America.

Dubai court upholds acquittal of two men in kidnapping and assault case

The Dubai Court of Appeal upheld the acquittal of two Emirati men accused of kidnapping and assault, ruling that evidence was insufficient to prove guilt beyond reasonable doubt.

UAE ready to surprise big teams at the Asia Cup 2025

UAE skipper Muhammad Waseem says his team has the right mix of youth and experience to challenge giants like India and Pakistan in the Asia Cup.

Two groups of Indian colleagues win $1million each in Dubai

Two groups of Indian colleagues struck $1 million each in Dubai Duty Free’s Millennium Millionaire draw, while two others drove away with luxury vehicles.

What Google can — and cannot do — after US court ruling: What happens next

A US judge has ordered Google to end exclusive default search deals but stopped short of forcing a Chrome divestiture. Here’s what changes — and what stays the same.

6 best places to visit in Kalba and Khorfakkan during the UAE long weekend

From mangroves and waterfalls to heritage villages and family parks, explore the natural beauty and cultural gems of Kalba and Khorfakkan during the UAE’s long weekend.

Google avoids Chrome sale in landmark antitrust ruling, must share search data

In a landmark US antitrust ruling, Google must share its search data with rivals but avoids harsher penalties like selling Chrome, reshaping competition in the tech industry.

UAE: Reader Disputes Dh39,119 Credit Card Fraud; Bank Steps In After Gulf News’ Intervention

Dubai resident disputes Dh39,119 fraud on ENBD card. Customer alleges OTP misuse; bank responds after Gulf News steps in.

New Crisis and Disaster Centre in Al Ain to Boost Emergency Response

A new disaster centre in Al Ain will speed up emergency response and enhance local crisis management.

Dubai Tailor Wins Dh20 Million in First Ever Big Ticket Entry

Dubai-based Bangladeshi tailor wins Dh20M in his first Big Ticket try; more prizes set for September and October draws.

Dubai Landlords Remove Illegal Partitions, Shift Focus to Families Over Bachelors

Dubai landlords remove illegal partitions and prefer family tenants amid crackdown on unauthorized modifications.

Digital Dirham to Revolutionize UAE’s Payment System with Secure, Inclusive Features

The UAE’s Digital Dirham is set to modernize payments with secure, inclusive features, offering fast, low-cost digital transactions.

Dubai Launches AI-Powered Self-Photo Studio with No Photographer

Dubai’s new AI-powered photo studio lets users take portraits in private, with no photographer — launching in Al Quoz this September.

Heavy Metal Icon Ozzy Osbourne Dies at 76

Legendary heavy metal singer Ozzy Osbourne, frontman of Black Sabbath and reality TV star, dies at 76.

UAE Issues Warning: BDS LTD.Seychelles Not Licensed for Financial Services

UAE warns investors that BDS LTD.Seychelles is unlicensed for financial services; urges public to avoid unregulated firms.

UAE Introduces New Licensing Rules for Lawyers and Legal Consultants

The UAE has approved new laws regulating lawyers and legal consultants, including licensing rules, ethics guidelines, and mandatory training.

UAE Deportation: Can Expats Return? Legal Process Explained

Deported from the UAE? Return is only possible with special approval. Here's how to apply and the documents required.

UAE Implements New Media Law with Fines Up to Dh1 Million: Full List of Penalties

The UAE’s new media law enforces strict penalties up to Dh1 million for violations including moral misconduct, misinformation, and unlicensed media activity.